- India

- /

- Professional Services

- /

- NSEI:CADSYS

Here's Why We Think Cadsys (India) (NSE:CADSYS) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Cadsys (India) (NSE:CADSYS), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Cadsys (India)

Cadsys (India)'s Improving Profits

Cadsys (India) has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Cadsys (India)'s EPS shot from ₹6.25 to ₹10.73, over the last year. Year on year growth of 72% is certainly a sight to behold.

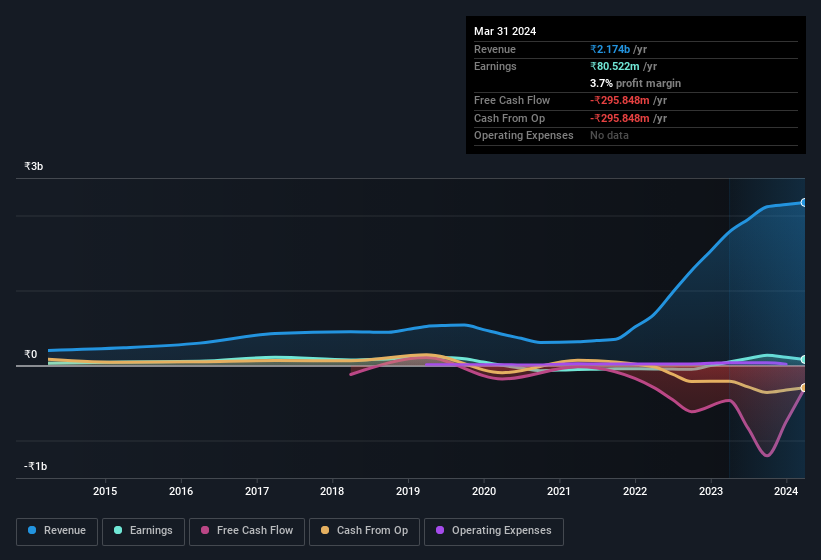

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Cadsys (India) shareholders can take confidence from the fact that EBIT margins are up from 5.7% to 10%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Cadsys (India) isn't a huge company, given its market capitalisation of ₹1.1b. That makes it extra important to check on its balance sheet strength.

Are Cadsys (India) Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Cadsys (India) insiders own a significant number of shares certainly is appealing. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Cadsys (India) being valued at ₹1.1b, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹723m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Cadsys (India) To Your Watchlist?

Cadsys (India)'s earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Cadsys (India) for a spot on your watchlist. Still, you should learn about the 3 warning signs we've spotted with Cadsys (India) (including 2 which are a bit unpleasant).

Although Cadsys (India) certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CADSYS

Cadsys (India)

A knowledge process outsourcing company, provides knowledge solutions in India and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives