- India

- /

- Electrical

- /

- NSEI:VMARCIND

V-MARC India Limited (NSE:VMARCIND) Stock Rockets 77% But Many Are Still Ignoring The Company

Those holding V-MARC India Limited (NSE:VMARCIND) shares would be relieved that the share price has rebounded 77% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 252% following the latest surge, making investors sit up and take notice.

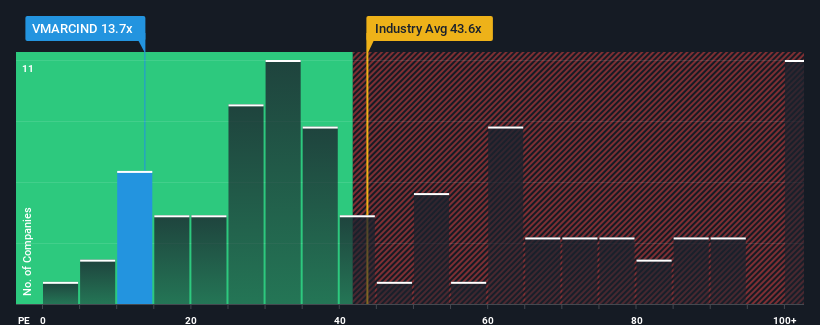

Even after such a large jump in price, V-MARC India's price-to-earnings (or "P/E") ratio of 13.7x might still make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 59x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, V-MARC India has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for V-MARC India

How Is V-MARC India's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like V-MARC India's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 157%. The latest three year period has also seen an excellent 242% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that V-MARC India is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in V-MARC India are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that V-MARC India currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for V-MARC India (of which 3 are concerning!) you should know about.

If these risks are making you reconsider your opinion on V-MARC India, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VMARCIND

V-MARC India

Manufactures and markets electrical wires and cables under the V-Marc brand name in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success