- India

- /

- Electrical

- /

- NSEI:VMARCIND

V-MARC India Limited (NSE:VMARCIND) Soars 29% But It's A Story Of Risk Vs Reward

Despite an already strong run, V-MARC India Limited (NSE:VMARCIND) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 118% following the latest surge, making investors sit up and take notice.

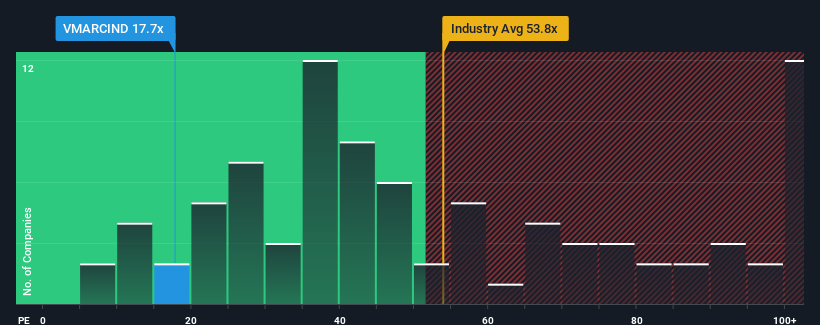

In spite of the firm bounce in price, V-MARC India may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.7x, since almost half of all companies in India have P/E ratios greater than 35x and even P/E's higher than 67x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

V-MARC India certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for V-MARC India

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like V-MARC India's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 157%. Pleasingly, EPS has also lifted 242% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that V-MARC India's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

V-MARC India's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that V-MARC India currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for V-MARC India you should be aware of, and 2 of them don't sit too well with us.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VMARCIND

V-MARC India

Manufactures and markets electrical wires and cables under the V-Marc brand name in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026