- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Jaiprakash Power Ventures And 2 Other Undiscovered Gems In India

Reviewed by Simply Wall St

The Indian market has experienced a 2.7% decline over the past week, yet it boasts a robust 40% increase over the last year with earnings projected to grow by 17% annually. In this dynamic environment, discovering stocks that offer potential for growth and resilience can provide valuable opportunities for investors seeking to capitalize on India's evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| 3B Blackbio Dx | 0.38% | -0.88% | -1.47% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both domestically and internationally, with a market capitalization of ₹151.67 billion.

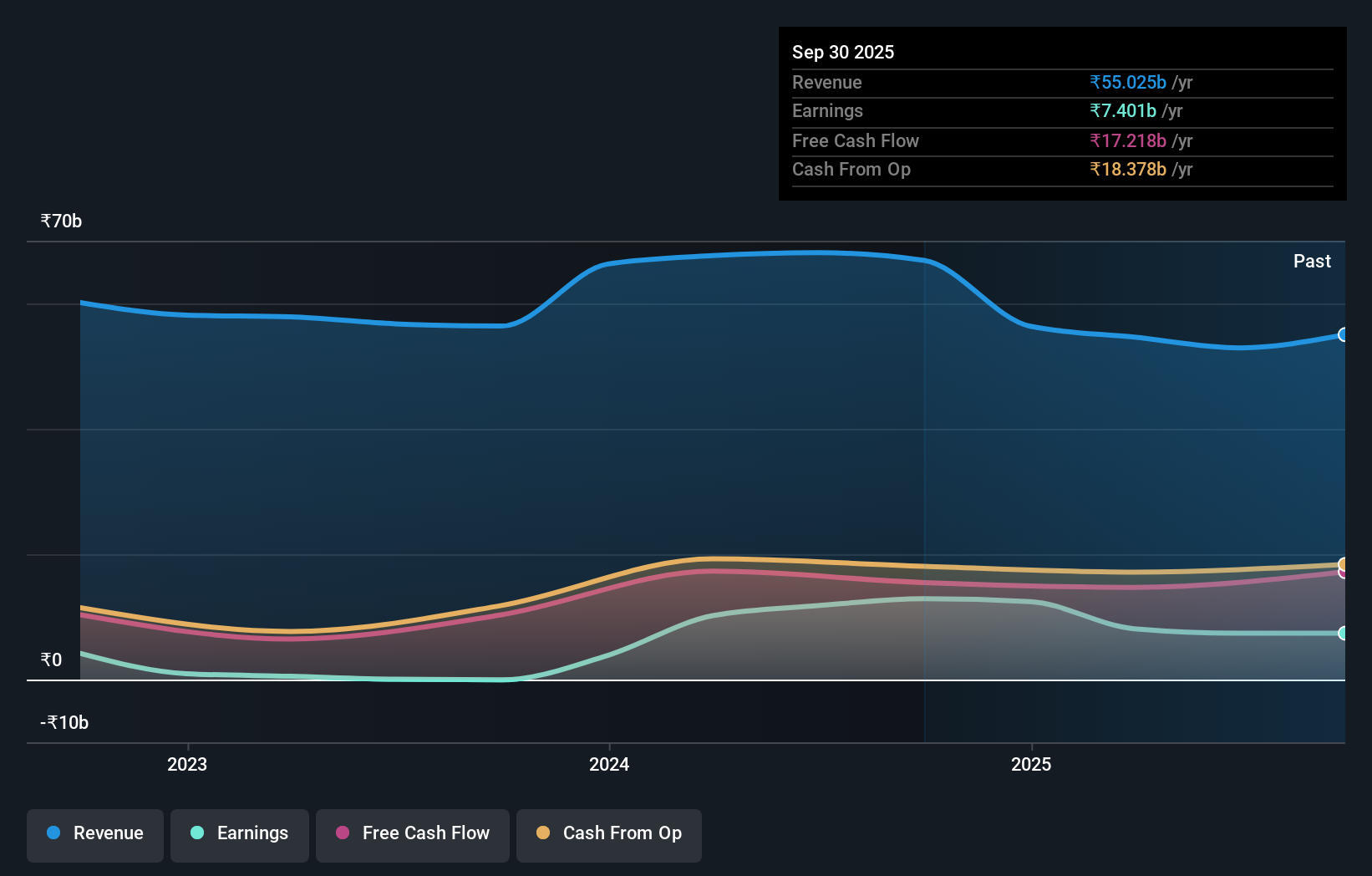

Operations: The primary revenue stream for Jaiprakash Power Ventures comes from its power segment, generating ₹61.68 billion. Coal contributes an additional ₹6.59 billion to the revenue mix.

Jaiprakash Power Ventures, a smaller player in India's renewable energy sector, has shown remarkable growth with earnings surging by 22969% over the past year, outpacing industry averages. Their net debt to equity ratio stands at a satisfactory 28.7%, down from 254.1% five years ago. Despite a notable ₹6.9 billion one-off loss impacting recent financials, the company trades at 63.6% below estimated fair value and maintains strong interest coverage of 5.2 times EBIT, indicating robust financial health amidst challenges.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacturing and sale of aluminium and copper fin and tube-type heat exchangers for the HVACR industry, with a market cap of ₹28.54 billion.

Operations: KRN Heat Exchanger and Refrigeration Limited generates its revenue primarily from the manufacture and sale of HVAC parts and accessories, amounting to ₹3.08 billion.

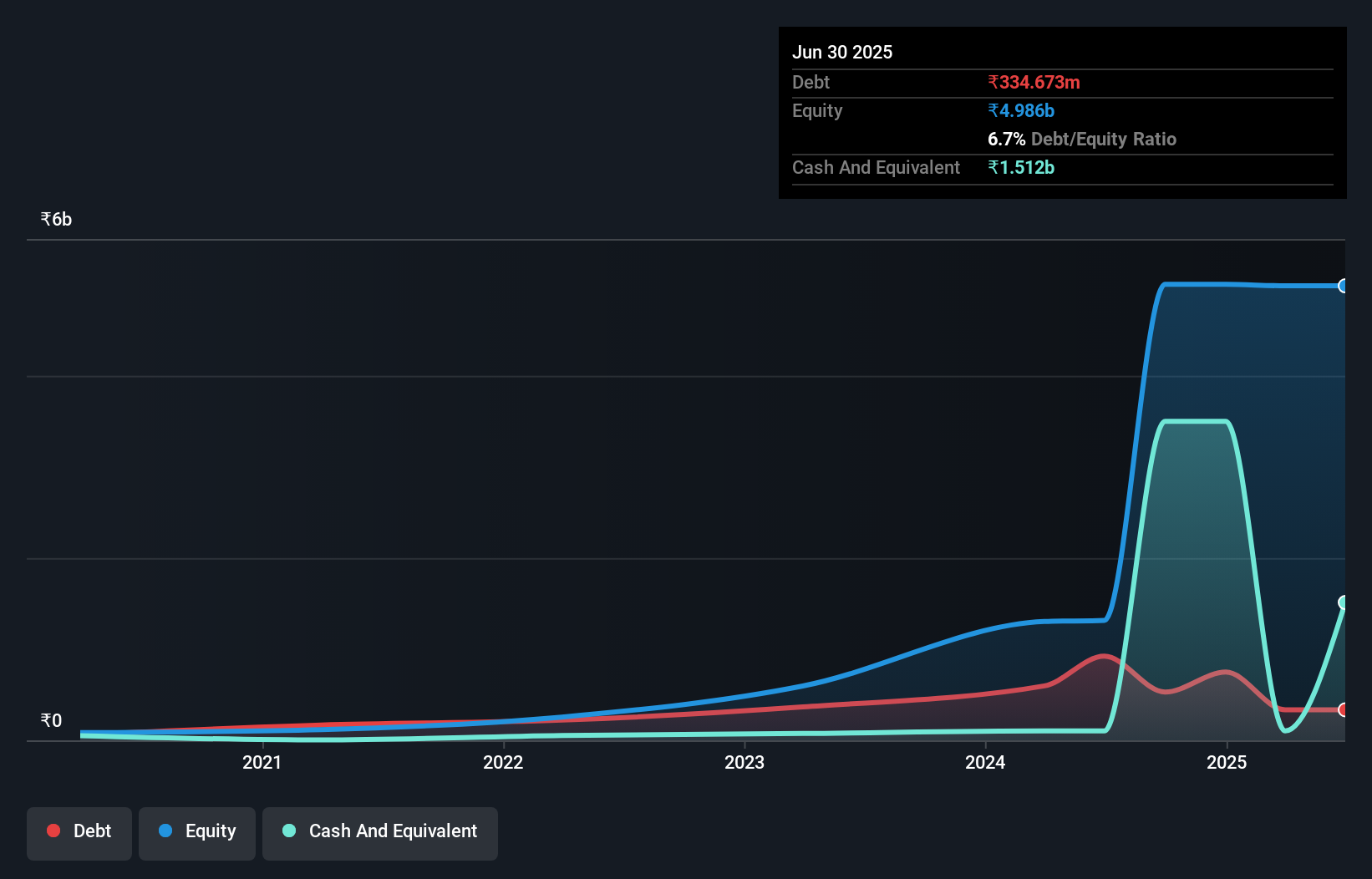

KRN Heat Exchanger and Refrigeration recently completed an IPO, raising INR 3.42 billion to expand its manufacturing capabilities. The company reported a significant increase in revenue to INR 3.14 billion from INR 2.50 billion the previous year, with net income rising to INR 390.69 million from INR 323.14 million. Its earnings growth of 20.9% outpaced the industry average, while maintaining a satisfactory net debt to equity ratio of 37.5%.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on generating solar power in India and has a market capitalization of ₹84.41 billion.

Operations: The primary revenue stream for Ujaas Energy Limited comes from its Solar Power Plant Operation, contributing ₹307.70 million. The Electric Vehicle segment adds ₹41.00 million to the revenue mix.

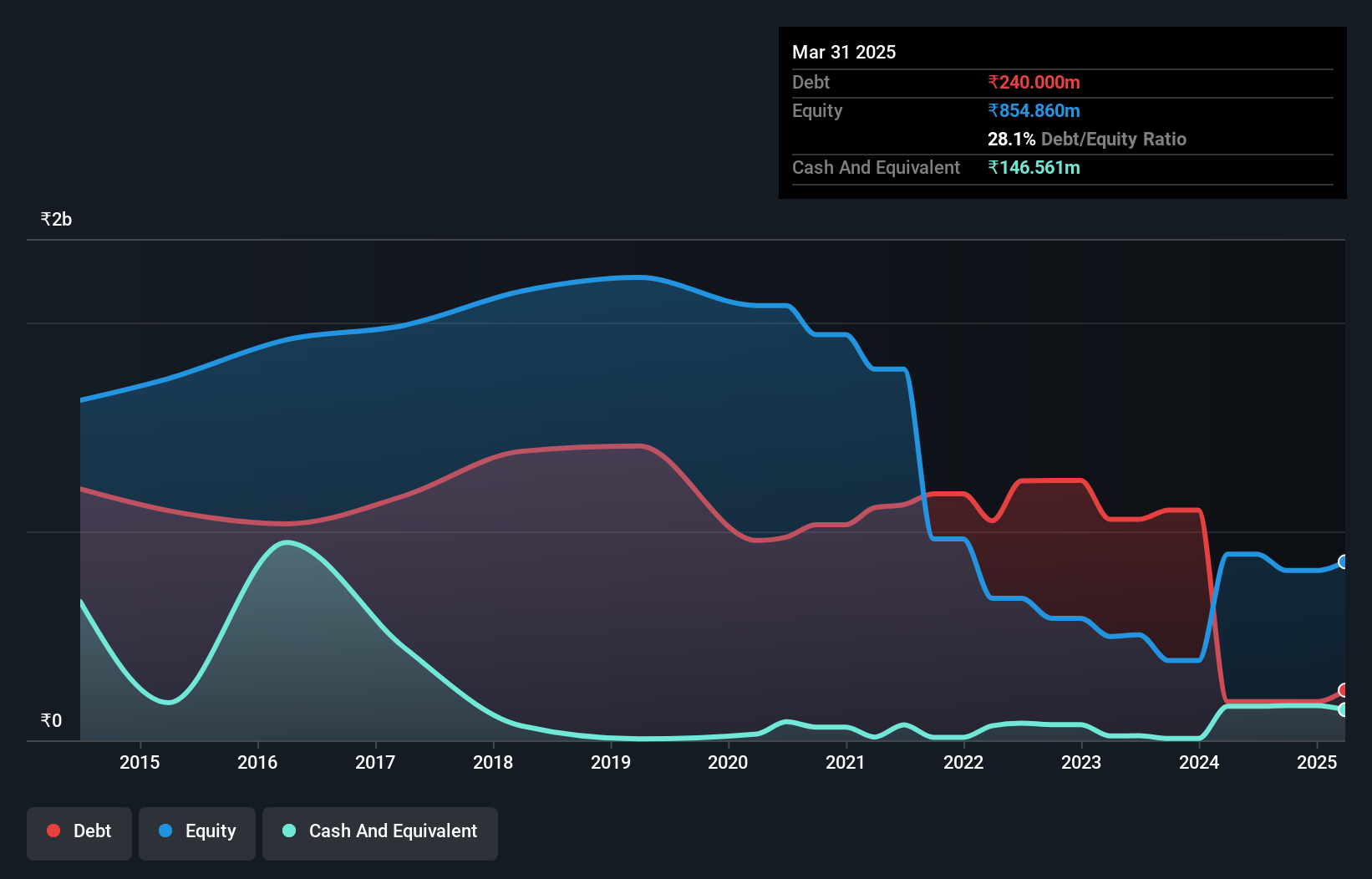

Ujaas Energy, a small player in India's energy sector, has shown significant financial restructuring with its debt to equity ratio dropping from 59.4% to 20.8% over five years and net debt to equity at a satisfactory 2.5%. Despite a large one-off loss of ₹91M impacting recent results, the company turned profitable this year with earnings of ₹38.15M for Q1 2024 compared to a net loss last year. Shares remain highly illiquid, posing challenges for investors seeking liquidity.

- Navigate through the intricacies of Ujaas Energy with our comprehensive health report here.

Understand Ujaas Energy's track record by examining our Past report.

Key Takeaways

- Click through to start exploring the rest of the 465 Indian Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India and internationally.

Excellent balance sheet and good value.