- India

- /

- Consumer Services

- /

- NSEI:NIITMTS

Three High Growth Companies With Significant Insider Ownership On The Indian Exchange

Reviewed by Simply Wall St

In the wake of the US Federal Reserve's unexpected 50 bps rate cut and its shift in policy, emerging markets are experiencing a boost, with India seeing an influx of FII inflows despite lagging behind its Asian counterparts in performance. Domestic benchmarks have reached new highs, driven primarily by large-cap stocks, while mid-and small-cap stocks show a negative bias. In this environment, identifying high-growth companies with significant insider ownership can be particularly rewarding. Such companies often exhibit strong alignment between management and shareholder interests, which is crucial for navigating market fluctuations and capitalizing on growth opportunities.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.2% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

We're going to check out a few of the best picks from our screener tool.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Apollo Hospitals Enterprise Limited, along with its subsidiaries, provides healthcare services in India and internationally and has a market cap of ₹1.04 trillion.

Operations: Apollo Hospitals Enterprise Limited generates revenue from three primary segments: Healthcare Services (₹102.83 billion), Retail Health & Diagnostics (₹14.12 billion), and Digital Health & Pharmacy Distribution (₹81.04 billion).

Insider Ownership: 10.4%

Apollo Hospitals Enterprise has demonstrated significant growth, with earnings increasing by 55.2% over the past year and revenue growing to ₹51.23 billion in Q1 2024 from ₹44.46 billion a year ago. Earnings are forecast to grow at an impressive 32.3% per year, outpacing the Indian market's average of 17.2%. Despite a high level of debt, the company maintains strong insider ownership and is expected to achieve a return on equity of 22% within three years.

- Get an in-depth perspective on Apollo Hospitals Enterprise's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Apollo Hospitals Enterprise's share price might be too optimistic.

NIIT Learning Systems (NSEI:NIITMTS)

Simply Wall St Growth Rating: ★★★★☆☆

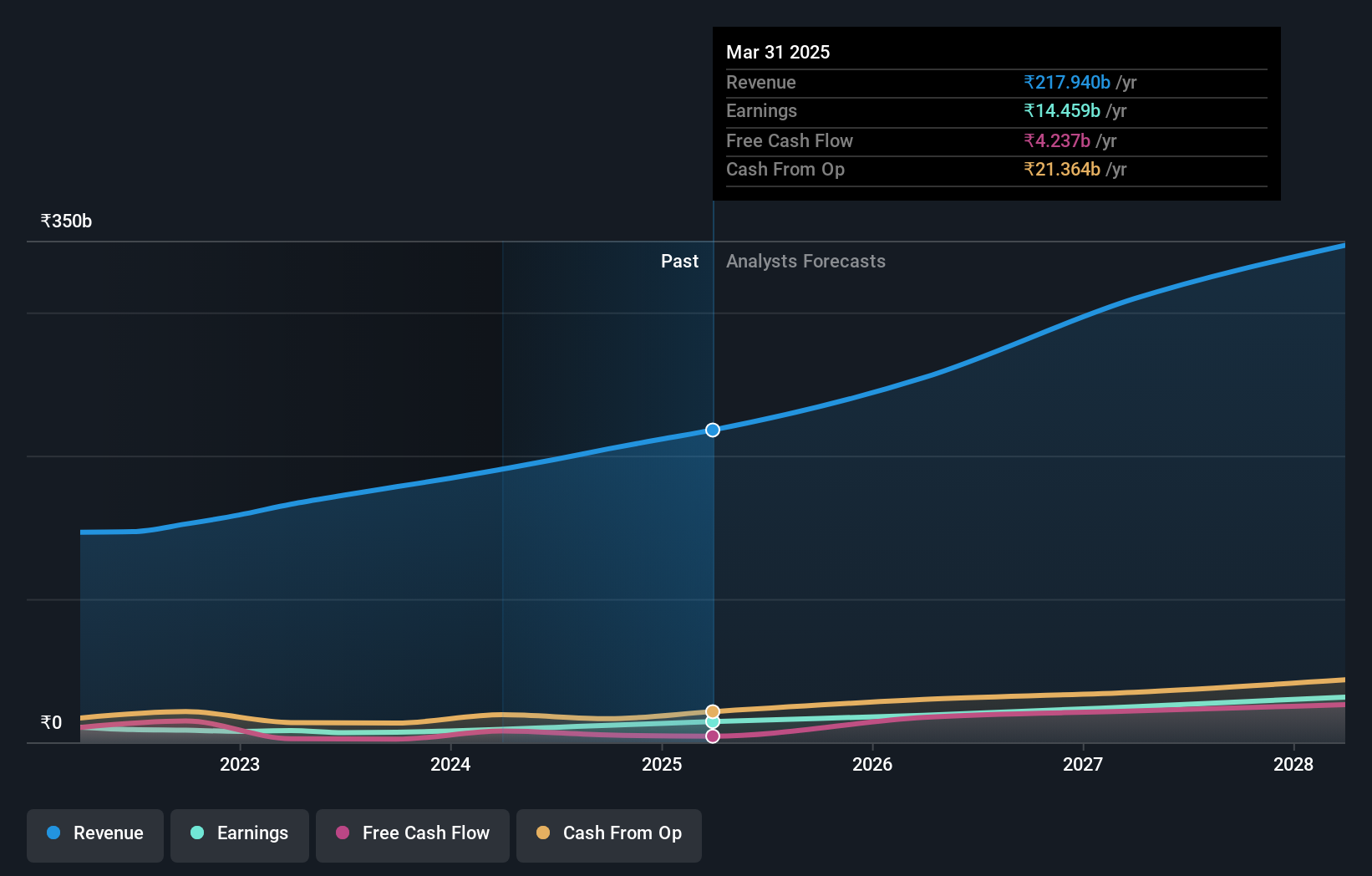

Overview: NIIT Learning Systems Limited provides managed training services across India, America, Europe, and internationally with a market cap of ₹69.97 billion.

Operations: The company's revenue from Education & Training Services is ₹15.78 billion.

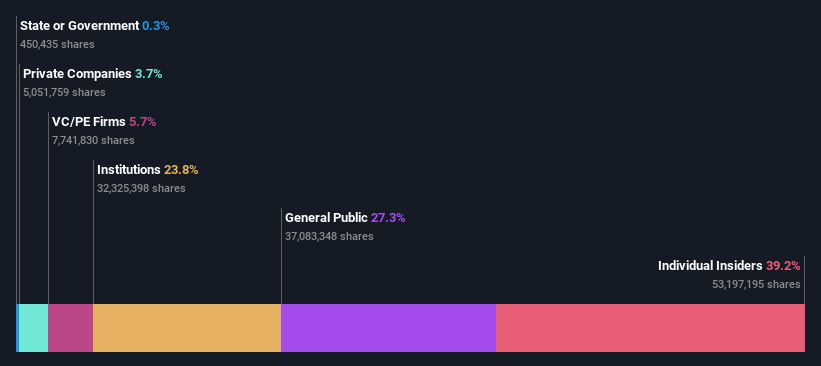

Insider Ownership: 39.2%

NIIT Learning Systems has shown steady growth, with Q1 2024 earnings rising to ₹600.19 million from ₹551.72 million a year ago. Despite slower revenue growth (13.9% per year) compared to peers, the company maintains strong insider ownership and is trading at a good value with a P/E ratio of 32.1x below the Indian market average of 34.1x. Recent strategic partnerships and consistent earnings forecast growth at 18.3% annually highlight its potential in the education technology sector.

- Dive into the specifics of NIIT Learning Systems here with our thorough growth forecast report.

- According our valuation report, there's an indication that NIIT Learning Systems' share price might be on the cheaper side.

Titagarh Rail Systems (NSEI:TITAGARH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹165.22 billion.

Operations: Revenue segments for Titagarh Rail Systems Limited include ₹3.32 billion from Passenger Rail Systems and ₹35.14 billion from Freight Rail Systems (including Shipbuilding, Bridges, and Defence).

Insider Ownership: 22.2%

Titagarh Rail Systems has demonstrated substantial growth, with earnings increasing by 65.4% over the past year and forecasted to grow significantly faster than the Indian market at 30.1% annually. Revenue is expected to rise by 25.7% per year, outpacing market growth. Despite trading at 43% below its estimated fair value, shareholders experienced dilution in the past year. Recent events include a final dividend declaration of ₹0.80 per share for FY2024 and consistent quarterly earnings performance.

- Navigate through the intricacies of Titagarh Rail Systems with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Titagarh Rail Systems is priced lower than what may be justified by its financials.

Key Takeaways

- Delve into our full catalog of 94 Fast Growing Indian Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NIIT Learning Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NIITMTS

NIIT Learning Systems

Offers managed training services in India, America, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives