Estimated 23.2% To 34.5% Discount Indian Stocks For Savvy Investors

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.1%, but it has risen by 41% in the last year, with earnings expected to grow by 17% per annum over the next few years. In this context, identifying stocks that are trading at a discount can present valuable opportunities for investors looking to capitalize on potential growth while mitigating risk.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NIIT Learning Systems (NSEI:NIITMTS) | ₹457.90 | ₹714.26 | 35.9% |

| Everest Kanto Cylinder (NSEI:EKC) | ₹167.31 | ₹304.38 | 45% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹660.85 | ₹1165.33 | 43.3% |

| RITES (NSEI:RITES) | ₹654.10 | ₹1047.85 | 37.6% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹386.10 | ₹762.32 | 49.4% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹833.85 | ₹1509.79 | 44.8% |

| Patel Engineering (BSE:531120) | ₹51.13 | ₹89.95 | 43.2% |

| Tarsons Products (NSEI:TARSONS) | ₹449.85 | ₹705.45 | 36.2% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹182.73 | ₹289.56 | 36.9% |

| Strides Pharma Science (NSEI:STAR) | ₹1226.30 | ₹2032.10 | 39.7% |

Here's a peek at a few of the choices from the screener.

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors both in India and internationally, with a market cap of ₹948.43 billion.

Operations: The company's revenue primarily comes from manufacturing steel products, amounting to ₹510.56 billion.

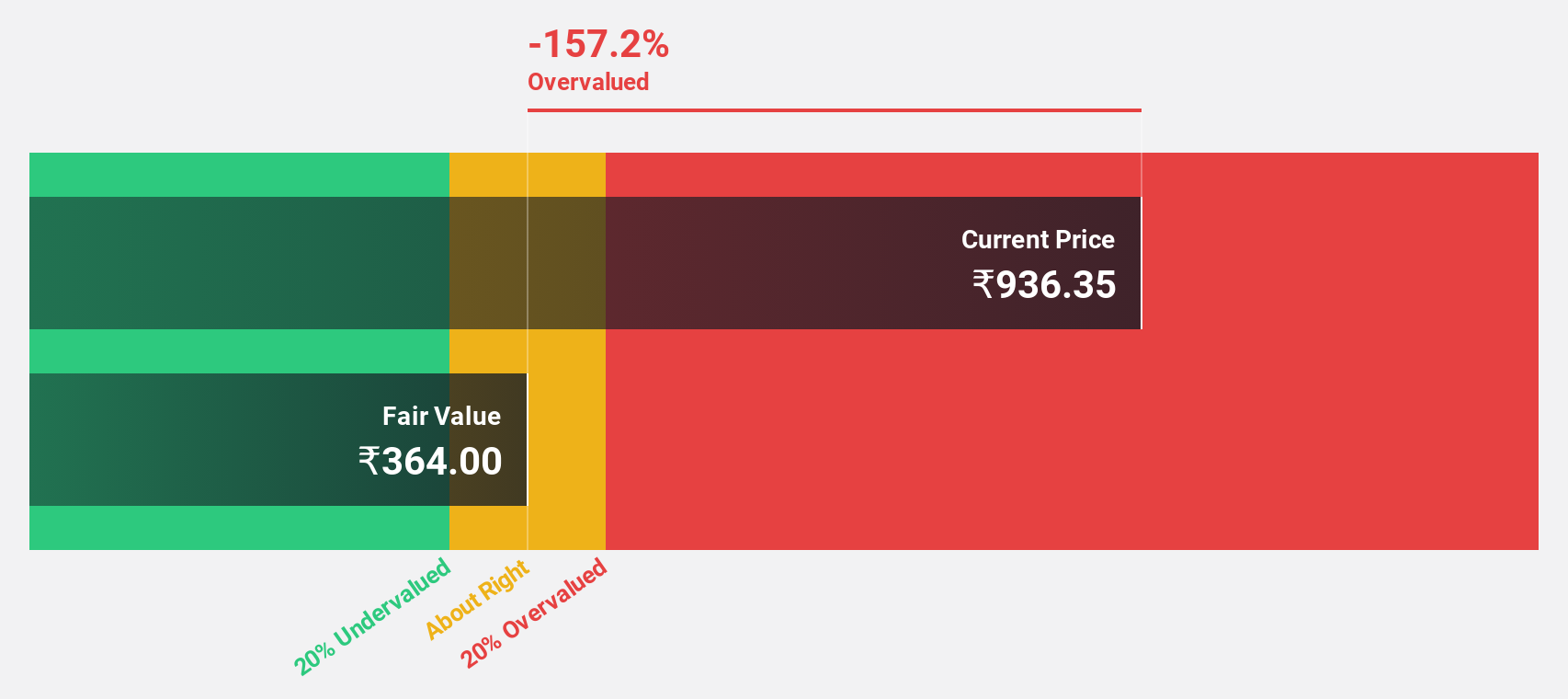

Estimated Discount To Fair Value: 23.2%

Jindal Steel & Power (₹929.75) is trading at 23.2% below its estimated fair value of ₹1210.47, indicating it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 24.1% per year, outpacing the Indian market's 16.9%. Recent earnings showed a slight decline in net income to ₹13,401.5 million despite increased sales and production stability, reflecting potential for future growth amidst current valuation discounts.

- Our expertly prepared growth report on Jindal Steel & Power implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Jindal Steel & Power's balance sheet health report.

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction services across various sectors including power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure both in India and internationally with a market cap of ₹199.88 billion.

Operations: The company's revenue segments include ₹2.81 billion from Development Projects and ₹194.92 billion from Engineering, Procurement, and Construction (EPC) services.

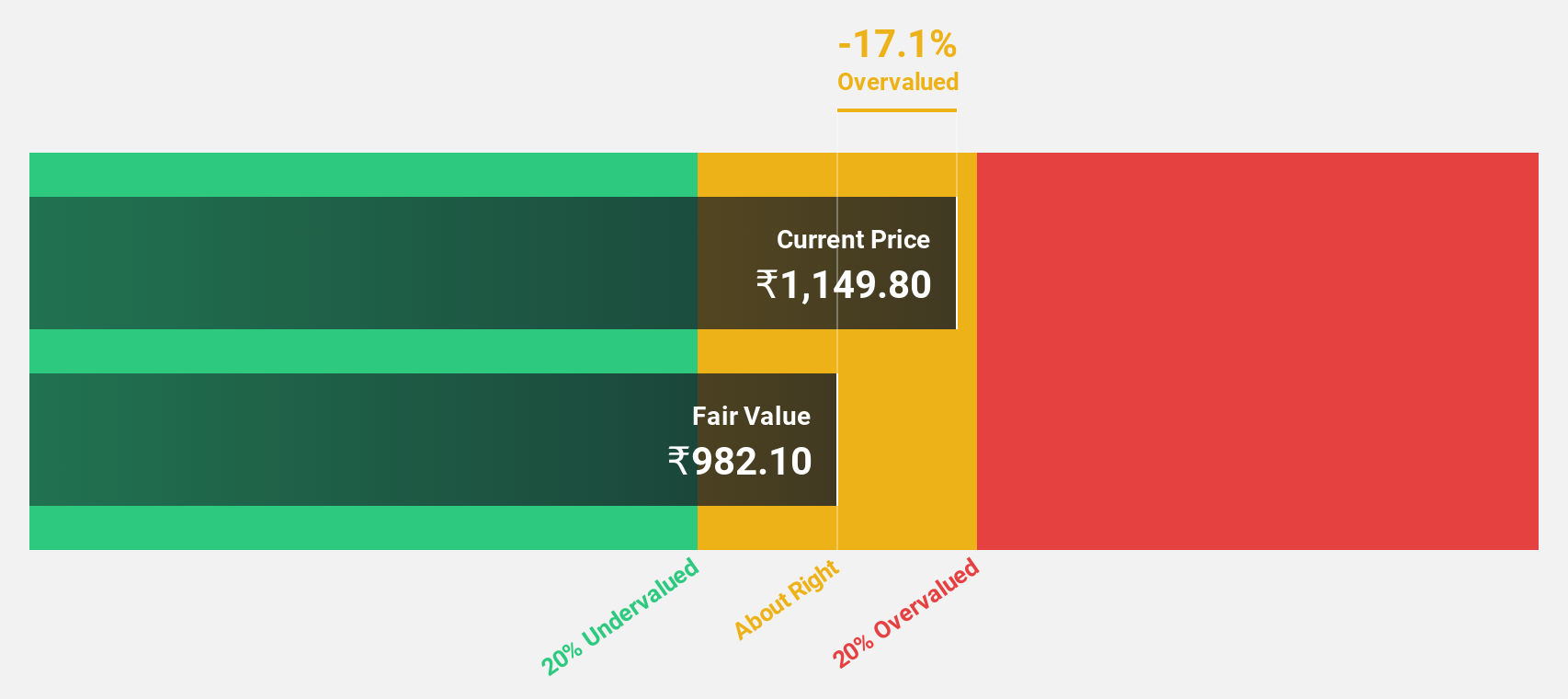

Estimated Discount To Fair Value: 28.3%

Kalpataru Projects International (₹1230.45) is trading at 28.3% below its estimated fair value of ₹1715.01, indicating undervaluation based on cash flows. Earnings are forecast to grow significantly at 29% per year, surpassing the Indian market's average of 16.9%. Despite a modest earnings growth of 0.6% annually over the past five years, recent regulatory actions and tax assessments have not significantly impacted financial stability, suggesting potential for future valuation adjustments amidst robust revenue forecasts.

- According our earnings growth report, there's an indication that Kalpataru Projects International might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Kalpataru Projects International.

Titagarh Rail Systems (NSEI:TITAGARH)

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹190.36 billion.

Operations: Revenue from passenger rail systems is ₹3.32 billion, while revenue from freight rail systems (including shipbuilding, bridges, and defense) totals ₹35.14 billion.

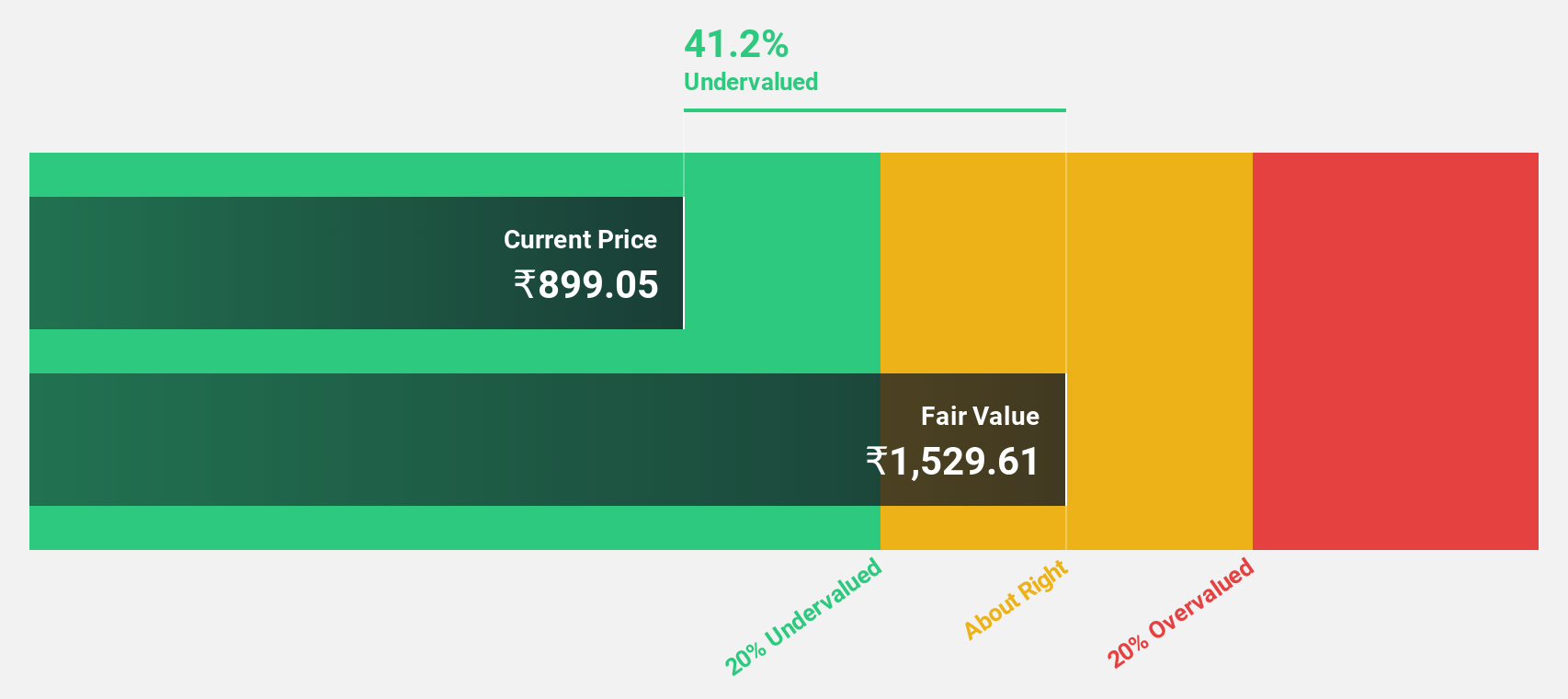

Estimated Discount To Fair Value: 34.5%

Titagarh Rail Systems (₹1413.5) is trading at 34.5% below its estimated fair value of ₹2158.79, reflecting significant undervaluation based on cash flows. Earnings are projected to grow at 30.1% annually, outpacing the Indian market's forecasted growth of 16.9%. Despite recent volatility in share price and past shareholder dilution, the company's involvement in major infrastructure projects like Bangalore Metro and ongoing investments in advanced production technologies bolster its revenue growth prospects, expected at 25.7% per year.

- Our earnings growth report unveils the potential for significant increases in Titagarh Rail Systems' future results.

- Get an in-depth perspective on Titagarh Rail Systems' balance sheet by reading our health report here.

Summing It All Up

- Get an in-depth perspective on all 30 Undervalued Indian Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titagarh Rail Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TITAGARH

Titagarh Rail Systems

Engages in the manufacture and sale of freight and passenger rail systems in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives