We Think Technocraft Industries (India) (NSE:TIIL) Is Taking Some Risk With Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Technocraft Industries (India) Limited (NSE:TIIL) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Technocraft Industries (India)

What Is Technocraft Industries (India)'s Debt?

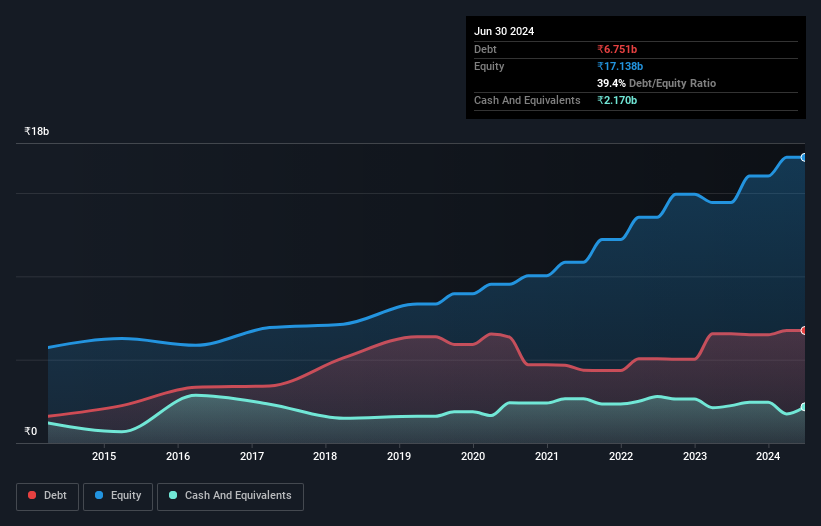

As you can see below, Technocraft Industries (India) had ₹6.75b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has ₹2.17b in cash leading to net debt of about ₹4.58b.

A Look At Technocraft Industries (India)'s Liabilities

The latest balance sheet data shows that Technocraft Industries (India) had liabilities of ₹7.73b due within a year, and liabilities of ₹2.06b falling due after that. Offsetting this, it had ₹2.17b in cash and ₹4.69b in receivables that were due within 12 months. So it has liabilities totalling ₹2.93b more than its cash and near-term receivables, combined.

Of course, Technocraft Industries (India) has a market capitalization of ₹71.7b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt sitting at just 1.2 times EBITDA, Technocraft Industries (India) is arguably pretty conservatively geared. And it boasts interest cover of 7.8 times, which is more than adequate. But the bad news is that Technocraft Industries (India) has seen its EBIT plunge 15% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Technocraft Industries (India) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Technocraft Industries (India) created free cash flow amounting to 8.4% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Both Technocraft Industries (India)'s EBIT growth rate and its conversion of EBIT to free cash flow were discouraging. But its not so bad at covering its interest expense with its EBIT. We think that Technocraft Industries (India)'s debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Technocraft Industries (India) has 1 warning sign we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Technocraft Industries (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIIL

Technocraft Industries (India)

Engages in scaffolding business in India and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives