If You Like EPS Growth Then Check Out Technocraft Industries (India) (NSE:TIIL) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Technocraft Industries (India) (NSE:TIIL), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Technocraft Industries (India)

How Quickly Is Technocraft Industries (India) Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Technocraft Industries (India) has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

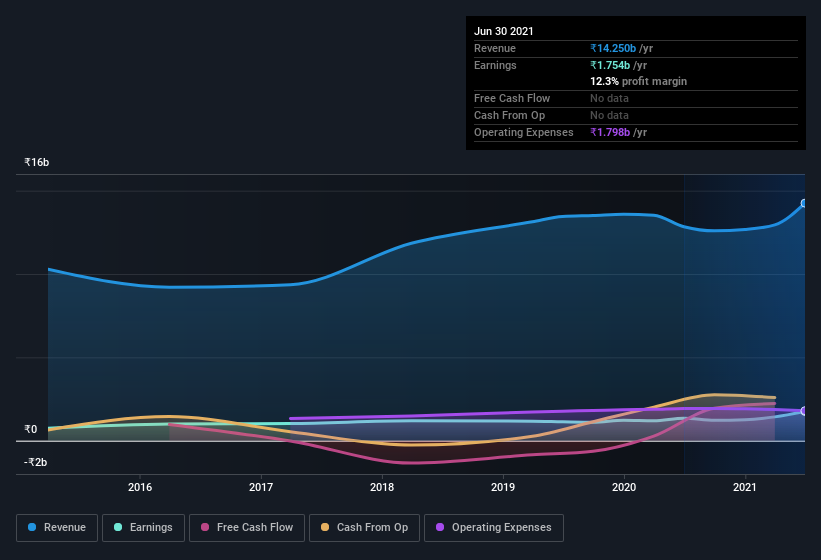

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Technocraft Industries (India) maintained stable EBIT margins over the last year, all while growing revenue 11% to ₹14b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Technocraft Industries (India)'s balance sheet strength, before getting too excited.

Are Technocraft Industries (India) Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that Technocraft Industries (India) insiders netted -₹1.7m worth of shares over the last year. But the silver lining to that cloud is that Subhash Khandelwal, the , spent ₹3.0m buying shares at an average price of ₹365. And that's a reason to be optimistic.

On top of the insider buying, we can also see that Technocraft Industries (India) insiders own a large chunk of the company. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping ₹17b. Now that's what I call some serious skin in the game!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Navneet Saraf, is paid less than the median for similar sized companies. For companies with market capitalizations between ₹15b and ₹59b, like Technocraft Industries (India), the median CEO pay is around ₹22m.

The Technocraft Industries (India) CEO received ₹15m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Technocraft Industries (India) To Your Watchlist?

One positive for Technocraft Industries (India) is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Still, you should learn about the 2 warning signs we've spotted with Technocraft Industries (India) .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Technocraft Industries (India), you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Technocraft Industries (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TIIL

Technocraft Industries (India)

Engages in scaffolding business in India and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives