It Looks Like The CEO Of Thejo Engineering Limited (NSE:THEJO) May Be Underpaid Compared To Peers

Key Insights

- Thejo Engineering will host its Annual General Meeting on 29th of August

- Salary of ₹6.55m is part of CEO Manoj Joseph's total remuneration

- The overall pay is 55% below the industry average

- Thejo Engineering's total shareholder return over the past three years was 221% while its EPS grew by 18% over the past three years

The solid performance at Thejo Engineering Limited (NSE:THEJO) has been impressive and shareholders will probably be pleased to know that CEO Manoj Joseph has delivered. At the upcoming AGM on 29th of August, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

View our latest analysis for Thejo Engineering

How Does Total Compensation For Manoj Joseph Compare With Other Companies In The Industry?

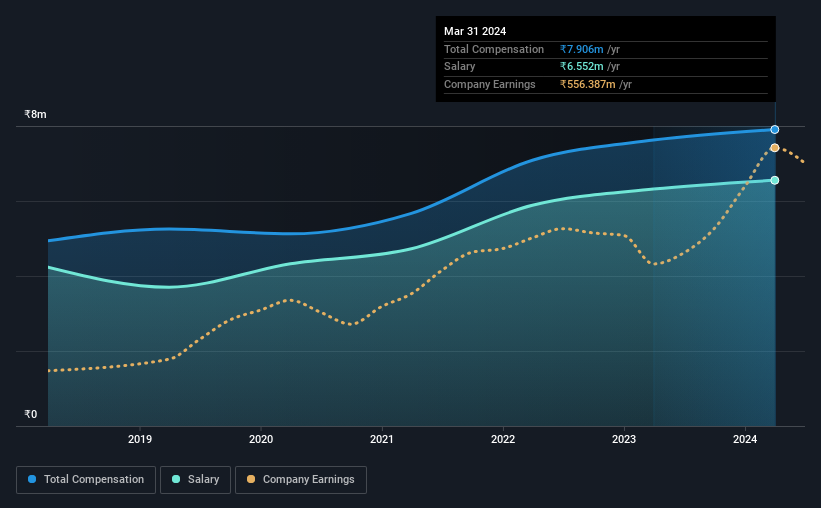

Our data indicates that Thejo Engineering Limited has a market capitalization of ₹31b, and total annual CEO compensation was reported as ₹7.9m for the year to March 2024. That's just a smallish increase of 3.7% on last year. Notably, the salary which is ₹6.55m, represents most of the total compensation being paid.

In comparison with other companies in the Indian Machinery industry with market capitalizations ranging from ₹17b to ₹67b, the reported median CEO total compensation was ₹18m. This suggests that Manoj Joseph is paid below the industry median. What's more, Manoj Joseph holds ₹1.4b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹6.6m | ₹6.3m | 83% |

| Other | ₹1.4m | ₹1.3m | 17% |

| Total Compensation | ₹7.9m | ₹7.6m | 100% |

On an industry level, around 91% of total compensation represents salary and 9% is other remuneration. There isn't a significant difference between Thejo Engineering and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Thejo Engineering Limited's Growth Numbers

Thejo Engineering Limited has seen its earnings per share (EPS) increase by 18% a year over the past three years. Its revenue is up 12% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Thejo Engineering Limited Been A Good Investment?

Most shareholders would probably be pleased with Thejo Engineering Limited for providing a total return of 221% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Thejo Engineering.

Important note: Thejo Engineering is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Thejo Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THEJO

Thejo Engineering

Designs, develops, manufactures, and supplies, rubber and polyurethane based engineering products for bulk material handling systems, mineral processing, and corrosion protection applications in India and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives