I Ran A Stock Scan For Earnings Growth And Thejo Engineering (NSE:THEJO) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Thejo Engineering (NSE:THEJO). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Thejo Engineering

How Fast Is Thejo Engineering Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Thejo Engineering has grown EPS by 41% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Thejo Engineering shareholders can take confidence from the fact that EBIT margins are up from 11% to 14%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

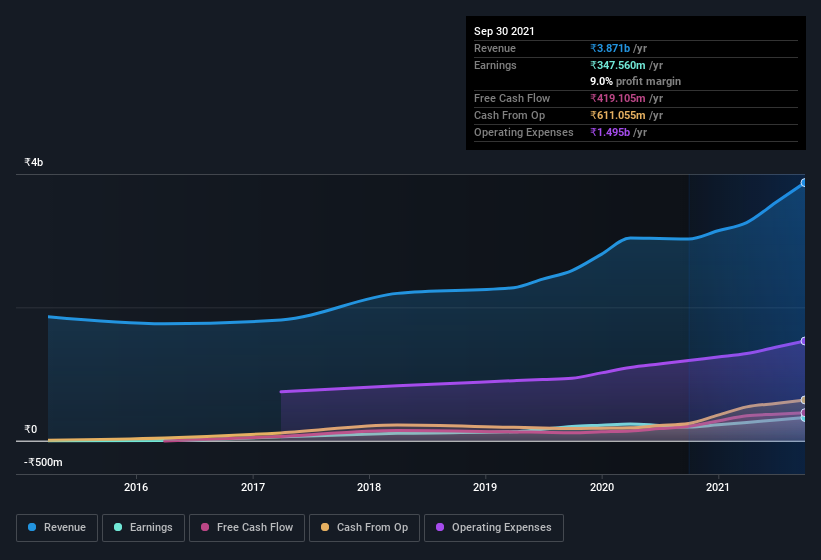

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Thejo Engineering is no giant, with a market capitalization of ₹12b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Thejo Engineering Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Thejo Engineering insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹7.6b invested in the business, using the current share price. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Thejo Engineering with market caps between ₹7.5b and ₹30b is about ₹15m.

The CEO of Thejo Engineering only received ₹5.7m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Thejo Engineering Deserve A Spot On Your Watchlist?

Thejo Engineering's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Thejo Engineering certainly ticks a few of my boxes, so I think it's probably well worth further consideration. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Thejo Engineering is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Thejo Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:THEJO

Thejo Engineering

Designs, develops, manufactures, and supplies rubber and polyurethane based engineering products for bulk material handling systems, mineral processing, and corrosion protection applications in India and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives