David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Tega Industries Limited (NSE:TEGA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Tega Industries

What Is Tega Industries's Debt?

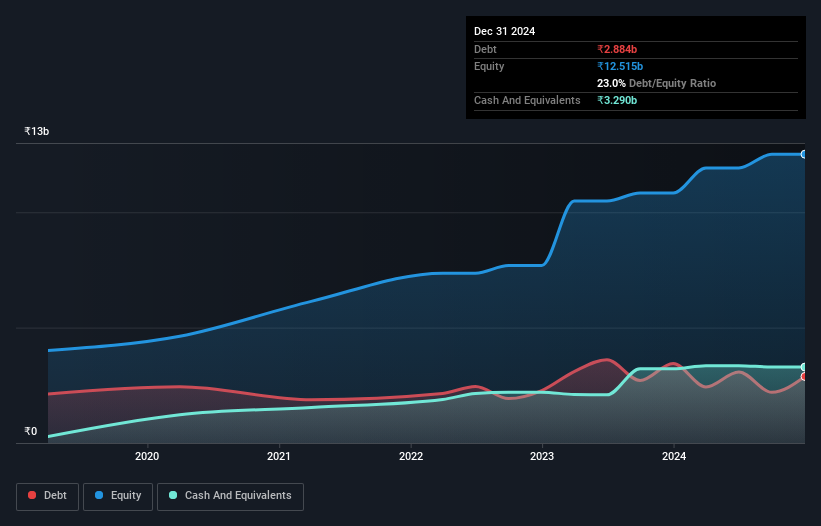

As you can see below, Tega Industries had ₹2.88b of debt at September 2024, down from ₹3.44b a year prior. However, its balance sheet shows it holds ₹3.29b in cash, so it actually has ₹406.8m net cash.

A Look At Tega Industries' Liabilities

According to the last reported balance sheet, Tega Industries had liabilities of ₹5.20b due within 12 months, and liabilities of ₹1.65b due beyond 12 months. Offsetting this, it had ₹3.29b in cash and ₹3.78b in receivables that were due within 12 months. So it can boast ₹218.5m more liquid assets than total liabilities.

Having regard to Tega Industries' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹90.4b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Tega Industries boasts net cash, so it's fair to say it does not have a heavy debt load!

Tega Industries's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Tega Industries's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Tega Industries has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Tega Industries produced sturdy free cash flow equating to 52% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to investigate a company's debt, in this case Tega Industries has ₹406.8m in net cash and a decent-looking balance sheet. So we don't have any problem with Tega Industries's use of debt. Over time, share prices tend to follow earnings per share, so if you're interested in Tega Industries, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Tega Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEGA

Tega Industries

Designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives