- India

- /

- Healthcare Services

- /

- NSEI:KIMS

3 Indian Growth Companies Insiders Own With 20% Revenue Growth

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped by 3.6%, yet it has shown significant resilience with a 40% rise over the past year and anticipated earnings growth of 17% per annum in the coming years. In this environment, identifying growth companies with high insider ownership can be a strategic move, as these firms often indicate strong internal confidence and have demonstrated impressive revenue growth of at least 20%.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.1% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 22.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

We're going to check out a few of the best picks from our screener tool.

Krishna Institute of Medical Sciences (NSEI:KIMS)

Simply Wall St Growth Rating: ★★★★★☆

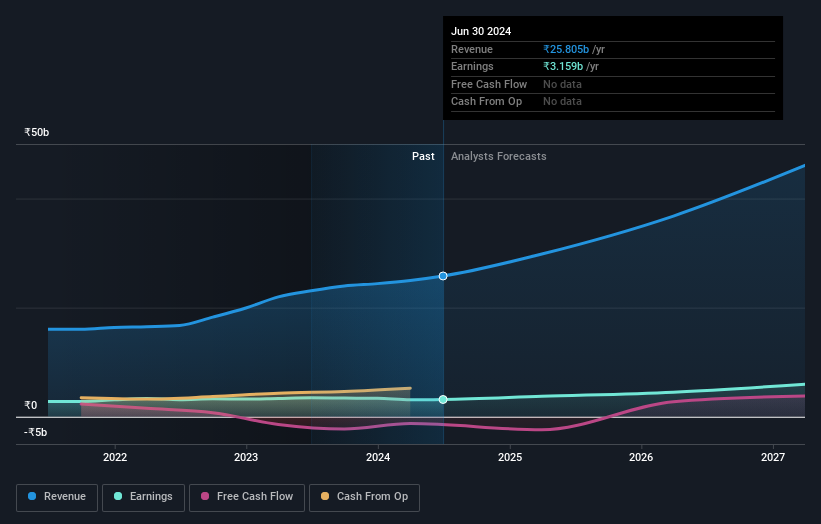

Overview: Krishna Institute of Medical Sciences Limited operates under the KIMS Hospitals brand, offering medical and healthcare services in India with a market cap of ₹219.98 billion.

Operations: The company generates revenue primarily from its medical and healthcare services segment, amounting to ₹25.81 billion.

Insider Ownership: 34%

Revenue Growth Forecast: 20.7% p.a.

Krishna Institute of Medical Sciences is experiencing strong growth, with revenue and earnings expected to increase over 20% annually, outpacing the Indian market. Despite a high debt level, its financial position supports this expansion. Recent events include a 5:1 stock split and changes in company bylaws approved at the AGM. The latest earnings report showed improved sales and net income compared to last year, reflecting positive momentum for this growth-oriented company.

- Navigate through the intricacies of Krishna Institute of Medical Sciences with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Krishna Institute of Medical Sciences implies its share price may be too high.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

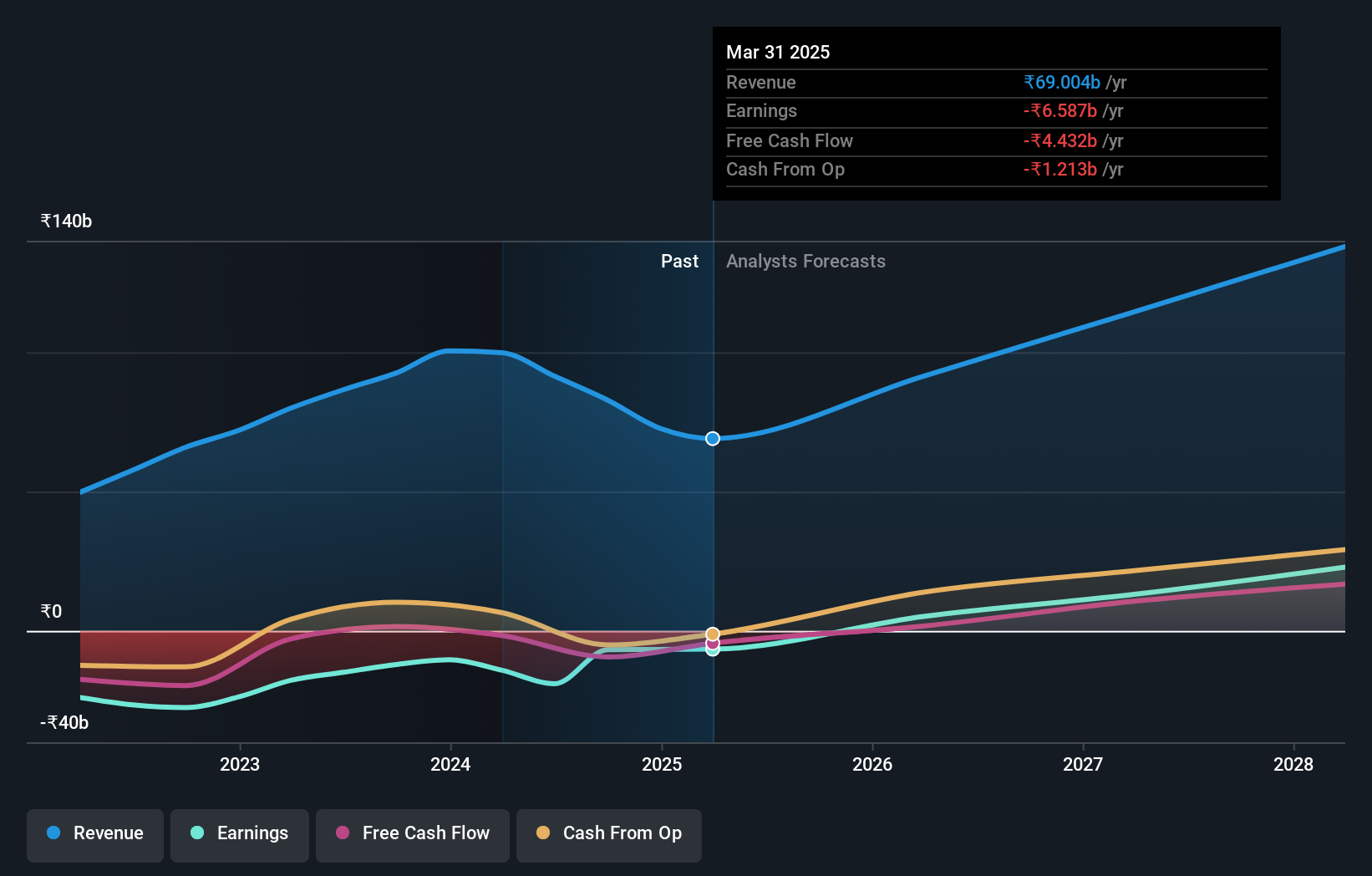

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants with a market cap of ₹442.56 billion.

Operations: The company's revenue is primarily derived from data processing, amounting to ₹91.38 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 12.1% p.a.

One97 Communications, owner of Paytm, is set to outpace the Indian market with an expected revenue growth of 12.1% annually. The company aims for profitability within three years, surpassing average market growth expectations. Recent strategic moves include selling its entertainment ticketing business for ₹20.48 billion to focus on core services and deploying 800 card machines in Madhya Pradesh's Krishi Mandis, enhancing digital transactions in agriculture. Despite recent penalties related to stamp duty issues, Paytm's initiatives highlight its commitment to innovation and financial empowerment.

- Unlock comprehensive insights into our analysis of One97 Communications stock in this growth report.

- Upon reviewing our latest valuation report, One97 Communications' share price might be too optimistic.

Tega Industries (NSEI:TEGA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tega Industries Limited designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries with a market cap of ₹128.65 billion.

Operations: The company's revenue is primarily derived from its Consumables segment, which accounts for ₹13.71 billion, followed by the Equipments segment at ₹1.98 billion.

Insider Ownership: 19%

Revenue Growth Forecast: 17% p.a.

Tega Industries is poised for significant growth, with earnings expected to increase by 24.7% annually, outpacing the Indian market's growth rate. Revenue is also forecast to grow at 17% per year. Recent financial performance shows strong results, with Q1 revenue rising to ₹3.52 billion from ₹2.76 billion a year ago and net income climbing to ₹367.44 million from ₹213.91 million last year, indicating robust operational momentum despite recent auditor changes and dividend affirmations.

- Click here and access our complete growth analysis report to understand the dynamics of Tega Industries.

- In light of our recent valuation report, it seems possible that Tega Industries is trading beyond its estimated value.

Key Takeaways

- Unlock more gems! Our Fast Growing Indian Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing Indian Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Krishna Institute of Medical Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KIMS

Krishna Institute of Medical Sciences

Provides medical and health care services under the KIMS Hospitals brand in India.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives