- India

- /

- Construction

- /

- NSEI:TECHNOE

With Techno Electric & Engineering Company Limited (NSE:TECHNOE) It Looks Like You'll Get What You Pay For

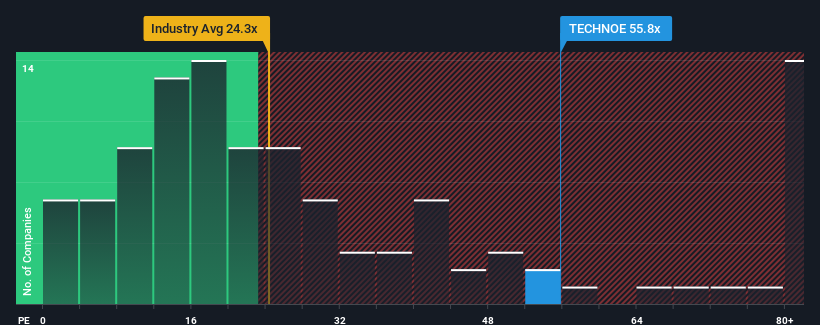

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 29x, you may consider Techno Electric & Engineering Company Limited (NSE:TECHNOE) as a stock to avoid entirely with its 55.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Techno Electric & Engineering could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Techno Electric & Engineering

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Techno Electric & Engineering's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. As a result, earnings from three years ago have also fallen 4.1% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

With this information, we can see why Techno Electric & Engineering is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Techno Electric & Engineering maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Techno Electric & Engineering has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives