- India

- /

- Construction

- /

- NSEI:TECHNOE

Uncovering July 2024's Undiscovered Gems In India

Reviewed by Simply Wall St

The Indian market has experienced a mix of dynamics recently, with a 1.5% decline over the last week contrasting sharply against a robust annual growth of 44%. In this context, identifying stocks that not only have strong fundamentals but also the potential for significant earnings growth becomes particularly compelling.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Deep Industries | 10.38% | 10.66% | 28.71% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.47% | 23.78% | ★★★★★★ |

| Om Infra | 13.99% | 43.48% | 23.30% | ★★★★★☆ |

| Alembic | 0.42% | 11.74% | -6.39% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Vasa Denticity | 0.11% | 38.86% | 55.93% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Network People Services Technologies (NSEI:NPST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Network People Services Technologies Limited specializes in creating digital payment solutions for banks, financial institutions, and merchants within the fintech sector in India, with a market capitalization of ₹46.44 billion.

Operations: The company generates revenue through the sale of products and services, consistently reflecting a gross profit margin increase over the years, notably from 51.64% in 2018 to over 40% by mid-2024. This growth trajectory is supported by managing operating and non-operating expenses effectively while expanding its revenue base significantly, reaching ₹1.63 billion by June 2024.

Network People Services Technologies (NPST) showcases a compelling growth trajectory, with earnings surging by 222.5% over the past year, significantly outpacing the diversified financial industry's growth of 21.3%. This performance is underpinned by robust financial health, evidenced by its debt to equity ratio of just 0.2%, and an EBIT coverage for interest payments at a strong 2279.1 times. Recent strategic moves include securing a major contract for a mobile banking solution, enhancing digital accessibility in rural banks—further solidifying its market position as an emerging gem in India’s financial sector.

- Take a closer look at Network People Services Technologies' potential here in our health report.

Understand Network People Services Technologies' track record by examining our Past report.

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company based in India that specializes in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals, with a market capitalization of ₹69.78 billion.

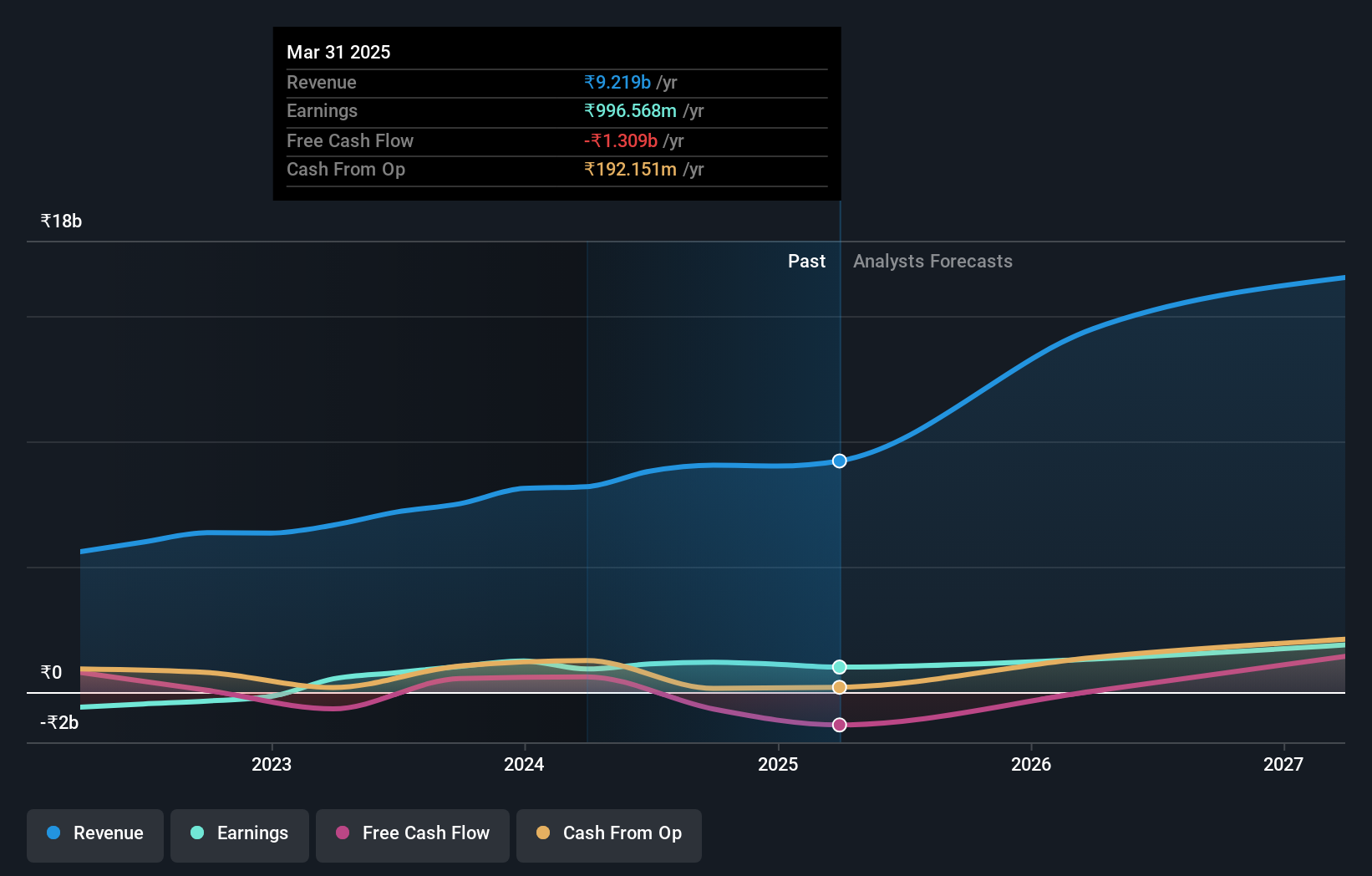

Operations: Orchid Pharma primarily generates revenue through its pharmaceutical segment, with a notable gross profit margin of 40.87% as of the latest quarter ending July 2024. The company's operational model involves significant costs in COGS and operating expenses, totaling ₹4.84 billion and ₹2.57 billion respectively in the same period, impacting its net income margin positively to stand at 11.25%.

Orchid Pharma, a lesser-known yet promising player in India's pharmaceutical sector, has shown notable achievements and robust growth prospects. Recently, the company reported a substantial earnings increase of 73.6% over the past year and anticipates future earnings growth at an impressive rate of 42.44% annually. Orchid's strategic partnership with Cipla for distributing its newly launched drug, Cefepime-Enmetazobactam, underscores its innovative capabilities and commitment to addressing critical healthcare needs. With more cash than total debt and high-quality earnings backed by a positive free cash flow, Orchid Pharma stands out as a compelling entity in the market.

- Click here and access our complete health analysis report to understand the dynamics of Orchid Pharma.

Gain insights into Orchid Pharma's past trends and performance with our Past report.

Techno Electric & Engineering (NSEI:TECHNOE)

Simply Wall St Value Rating: ★★★★★★

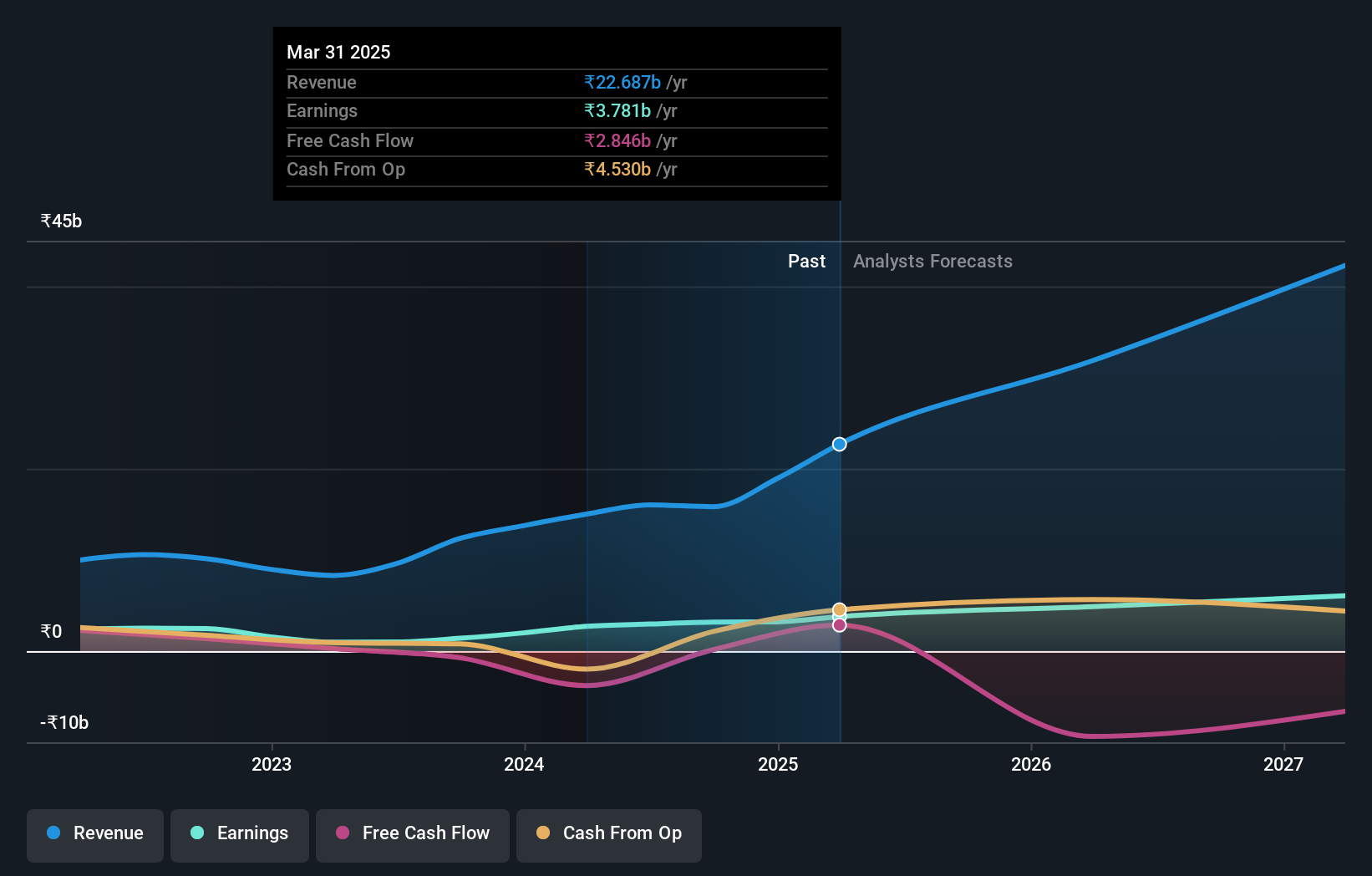

Overview: Techno Electric & Engineering Company Limited is an Indian firm specializing in engineering, procurement, and construction services for the power generation, transmission, and distribution sectors, with a market capitalization of ₹166.06 billion.

Operations: The company primarily operates in the Engineering, Procurement, and Construction (EPC) sector, contributing significantly to its revenue with ₹14.92 billion from this segment. It has demonstrated a capability to manage substantial operating and non-operating expenses while achieving a net income margin of 18.04% as of the latest reporting period in 2024.

Techno Electric & Engineering's recent fiscal performance and strategic wins position it as a compelling entity in the construction sector. With a debt-free status and earnings that have surged by 180.5% over the past year, outpacing industry growth of 36.5%, the company showcases robust financial health. Recent contracts, including a significant INR 40630 million order from diverse high-profile clients, underscore its operational prowess and market confidence. Moreover, an impressive forecast suggests earnings could grow by another 27% annually, highlighting its potential amidst peers.

- Click to explore a detailed breakdown of our findings in Techno Electric & Engineering's health report.

Learn about Techno Electric & Engineering's historical performance.

Where To Now?

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 452 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives