- India

- /

- Construction

- /

- NSEI:TECHNOE

Exploring Three Undiscovered Gems In Indian Stocks July 2024

Reviewed by Simply Wall St

In the past year, the Indian stock market has shown remarkable resilience with a 43% increase, despite a recent 2.0% drop over the last week. In this context of robust annual earnings growth forecasted at 16%, identifying stocks that have not yet caught the attention of mainstream investors could offer unique opportunities for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Deep Industries | 10.38% | 10.66% | 28.71% | ★★★★★★ |

| BLS E-Services | NA | 43.93% | 59.81% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.47% | 23.78% | ★★★★★★ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 18.19% | 3.65% | ★★★★★☆ |

| Vasa Denticity | 0.11% | 38.86% | 55.93% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

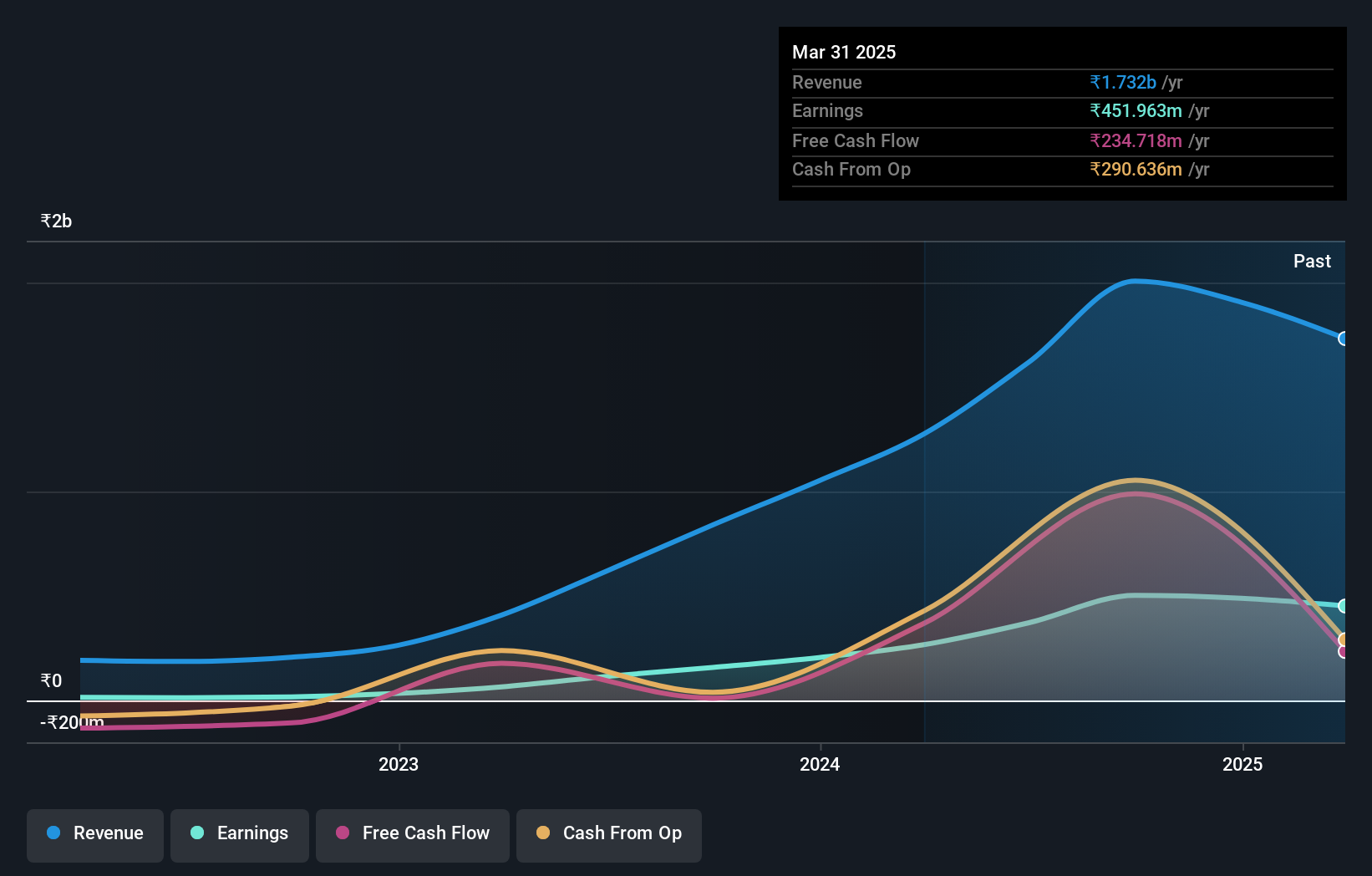

Network People Services Technologies (NSEI:NPST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Network People Services Technologies Limited specializes in creating digital payment solutions for banks, financial institutions, and merchants within the fintech sector in India, with a market capitalization of ₹46.44 billion.

Operations: The company generates its revenue primarily through the sale of goods and services, evidenced by a consistent increase in gross profit from ₹90.50 million in 2018 to ₹660.98 million by mid-2024, reflecting an upward trend in efficiency and market reach. Despite fluctuations, the net income has also shown significant growth from ₹12.45 million to ₹371.89 million over the same period, underlining robust operational management and possibly improved cost efficiencies or market expansion strategies.

Network People Services Technologies (NPST), a rising star in India's financial sector, reported a remarkable earnings growth of 222.5% over the past year, surpassing the industry average of 21.3%. With more cash than debt and interest payments covered 2279 times by EBIT, NPST demonstrates robust financial health. Recent developments include securing a significant contract to provide mobile banking solutions to rural banks, enhancing digital accessibility and driving future growth prospects.

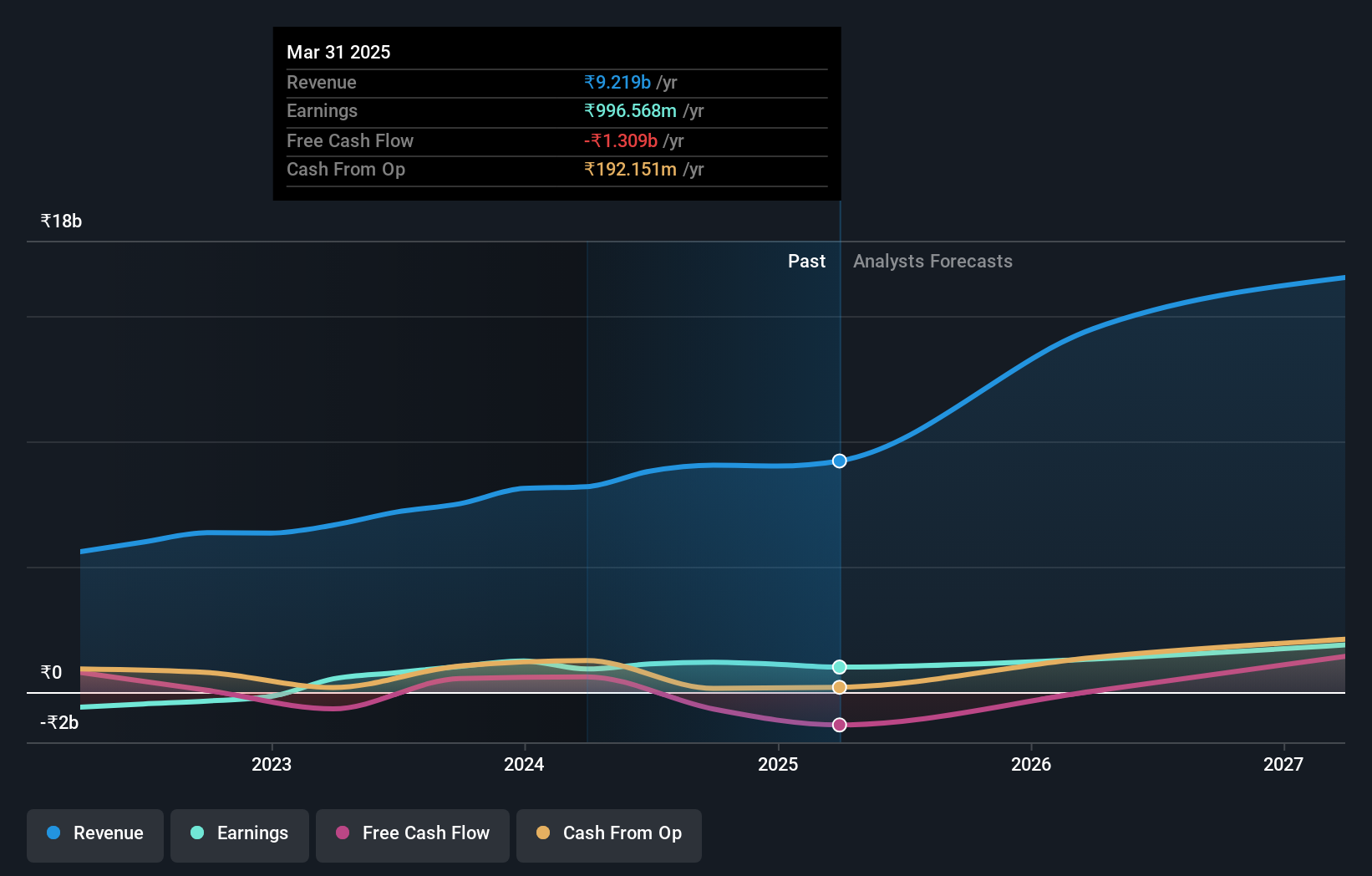

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company based in India, specializing in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals, with a market capitalization of ₹69.78 billion.

Operations: Orchid Pharma generates its revenue primarily through the pharmaceuticals sector, with recent figures showing a revenue of ₹8.19 billion. The company's operations involve significant costs related to goods sold and operating expenses, impacting profitability metrics such as the net income margin which recently stood at approximately 11.25%.

Orchid Pharma, a rising star in India's pharmaceutical landscape, has demonstrated robust performance with a 73.6% earnings growth over the past year, outpacing the industry's 17%. The company boasts high-quality earnings and is well-positioned financially with more cash than debt. Recent strategic partnerships for distributing new drugs underline its commitment to addressing critical healthcare needs, reinforcing its potential as an undiscovered gem in the market.

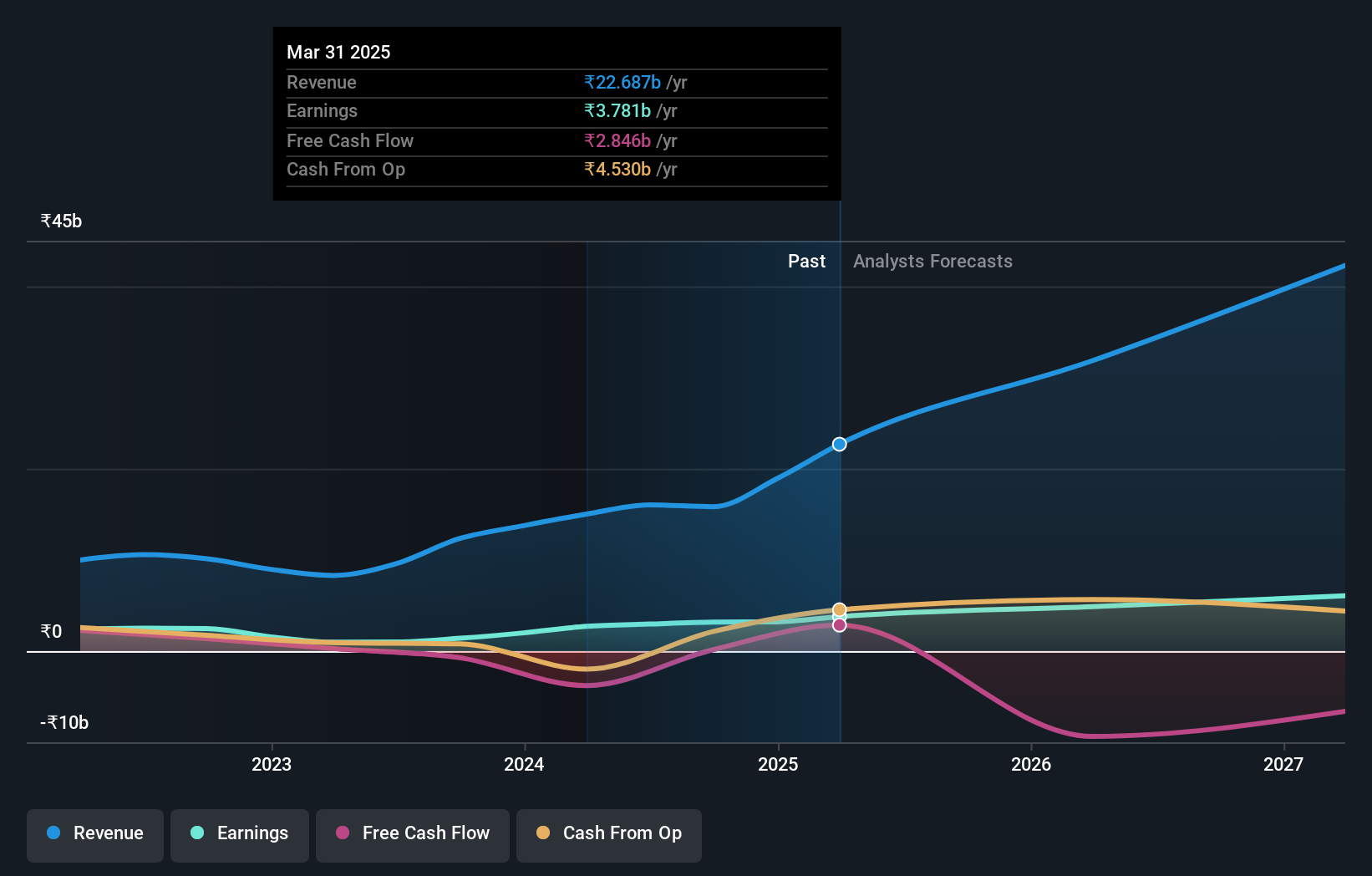

Techno Electric & Engineering (NSEI:TECHNOE)

Simply Wall St Value Rating: ★★★★★★

Overview: Techno Electric & Engineering Company Limited specializes in engineering, procurement, and construction services for the power generation, transmission, and distribution sectors in India, with a market capitalization of ₹166.06 billion.

Operations: The company primarily operates in the Engineering, Procurement, and Construction (EPC) sector, generating ₹14.92 billion from this segment. It also earns revenue from other business activities amounting to ₹104.38 million.

Techno Electric & Engineering's recent performance showcases significant growth, with earnings surging by 180.5% over the past year, outpacing the construction industry's 36.5% growth. The company is debt-free, a notable improvement from a debt-to-equity ratio of 3.1 five years ago. Forecasted to grow earnings by 27.48% annually, Techno Electric also benefits from high non-cash earnings levels, indicating robust underlying financial health despite a volatile share price recently.

- Click here to discover the nuances of Techno Electric & Engineering with our detailed analytical health report.

Gain insights into Techno Electric & Engineering's past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 452 Indian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion