- India

- /

- Construction

- /

- NSEI:TARMAT

Returns On Capital Signal Difficult Times Ahead For Tarmat (NSE:TARMAT)

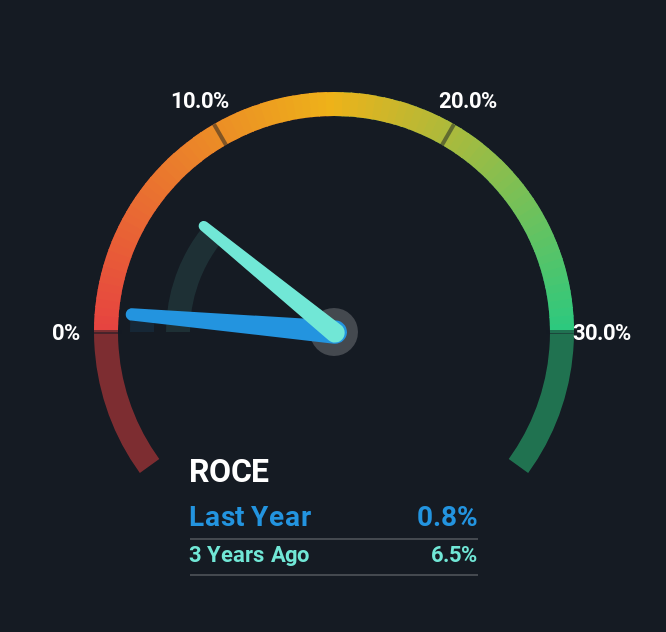

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. Having said that, after a brief look, Tarmat (NSE:TARMAT) we aren't filled with optimism, but let's investigate further.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Tarmat is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0083 = ₹15m ÷ (₹2.4b - ₹604m) (Based on the trailing twelve months to March 2025).

Therefore, Tarmat has an ROCE of 0.8%. Ultimately, that's a low return and it under-performs the Construction industry average of 15%.

View our latest analysis for Tarmat

Historical performance is a great place to start when researching a stock so above you can see the gauge for Tarmat's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Tarmat.

So How Is Tarmat's ROCE Trending?

There is reason to be cautious about Tarmat, given the returns are trending downwards. To be more specific, the ROCE was 6.2% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect Tarmat to turn into a multi-bagger.

On a side note, Tarmat has done well to pay down its current liabilities to 26% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

Our Take On Tarmat's ROCE

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Since the stock has skyrocketed 128% over the last five years, it looks like investors have high expectations of the stock. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

If you'd like to know more about Tarmat, we've spotted 3 warning signs, and 1 of them makes us a bit uncomfortable.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Tarmat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARMAT

Tarmat

Engages in the construction of airfield and national/state highways in India.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives