- India

- /

- Electrical

- /

- NSEI:TARIL

If EPS Growth Is Important To You, Transformers and Rectifiers (India) (NSE:TARIL) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Transformers and Rectifiers (India) (NSE:TARIL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Transformers and Rectifiers (India) Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Transformers and Rectifiers (India) to have grown EPS from ₹1.62 to ₹7.14 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

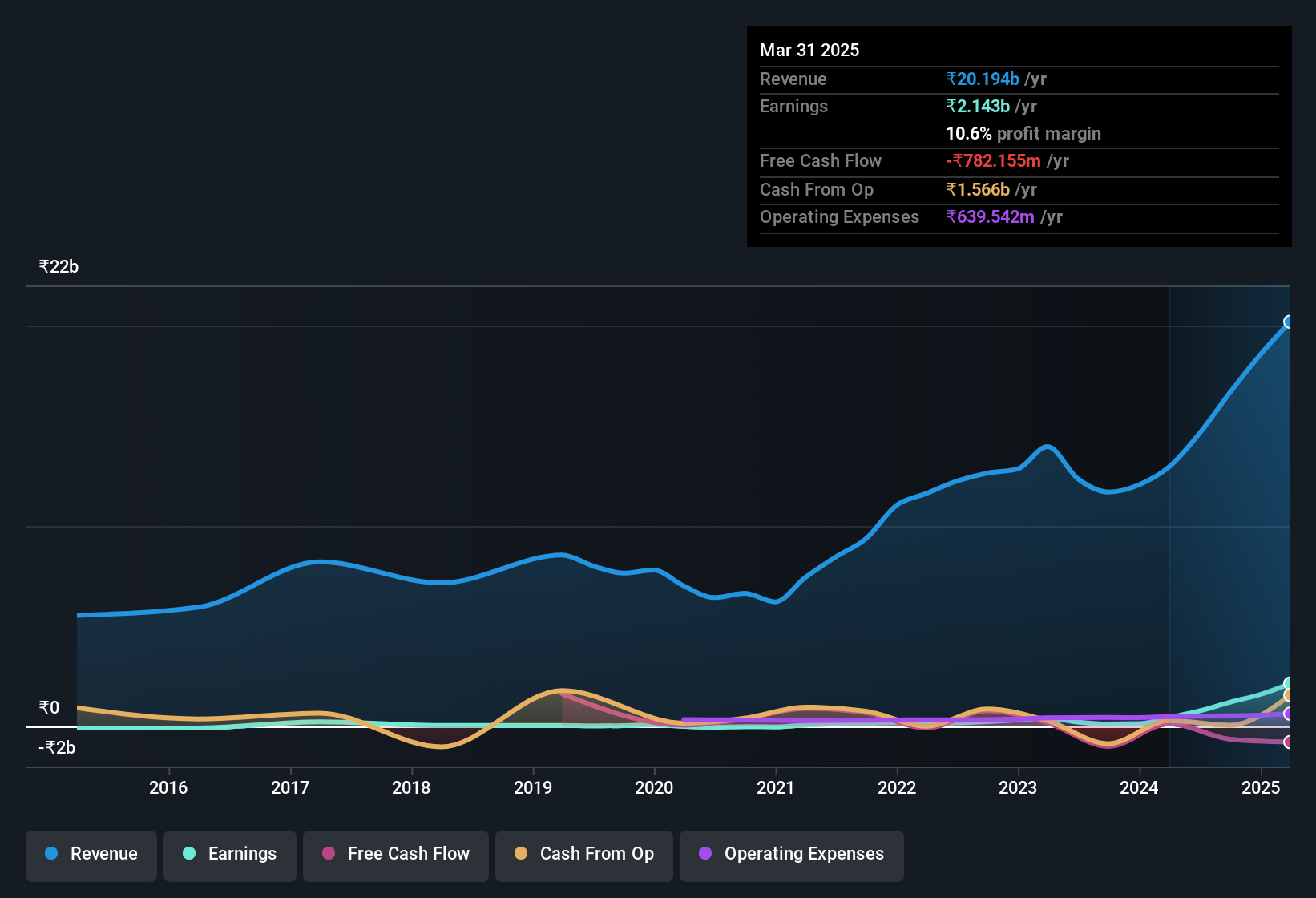

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Transformers and Rectifiers (India) is growing revenues, and EBIT margins improved by 6.4 percentage points to 15%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Transformers and Rectifiers (India)

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Transformers and Rectifiers (India)'s future EPS 100% free.

Are Transformers and Rectifiers (India) Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Transformers and Rectifiers (India) insiders own a meaningful share of the business. To be exact, company insiders hold 68% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. And their holding is extremely valuable at the current share price, totalling ₹97b. That level of investment from insiders is nothing to sneeze at.

Should You Add Transformers and Rectifiers (India) To Your Watchlist?

Transformers and Rectifiers (India)'s earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Transformers and Rectifiers (India) is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. You should always think about risks though. Case in point, we've spotted 1 warning sign for Transformers and Rectifiers (India) you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Transformers and Rectifiers (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARIL

Transformers and Rectifiers (India)

Manufactures and sells transformers in India.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives