- India

- /

- Trade Distributors

- /

- NSEI:TARACHAND

Take Care Before Diving Into The Deep End On Tara Chand Logistic Solutions Limited (NSE:TARACHAND)

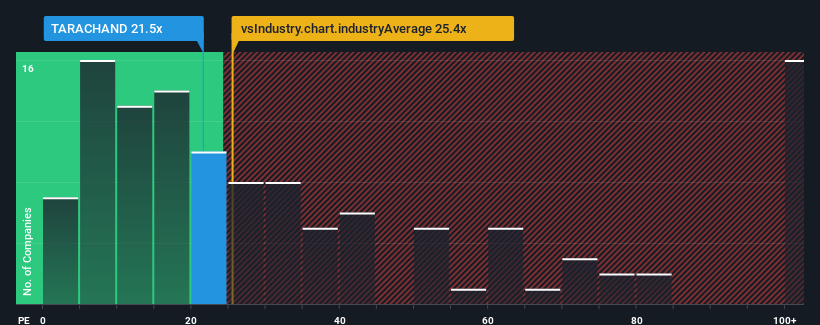

Tara Chand Logistic Solutions Limited's (NSE:TARACHAND) price-to-earnings (or "P/E") ratio of 21.5x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 27x and even P/E's above 51x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Tara Chand Logistic Solutions as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Tara Chand Logistic Solutions

Is There Any Growth For Tara Chand Logistic Solutions?

In order to justify its P/E ratio, Tara Chand Logistic Solutions would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 83%. Pleasingly, EPS has also lifted 1,110% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Tara Chand Logistic Solutions is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Tara Chand Logistic Solutions revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Tara Chand Logistic Solutions that you need to be mindful of.

You might be able to find a better investment than Tara Chand Logistic Solutions. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tara Chand Infralogistic Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARACHAND

Tara Chand Infralogistic Solutions

Provides logistics solutions in India.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026