Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Suzlon Energy Limited (NSE:SUZLON) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Suzlon Energy

What Is Suzlon Energy's Debt?

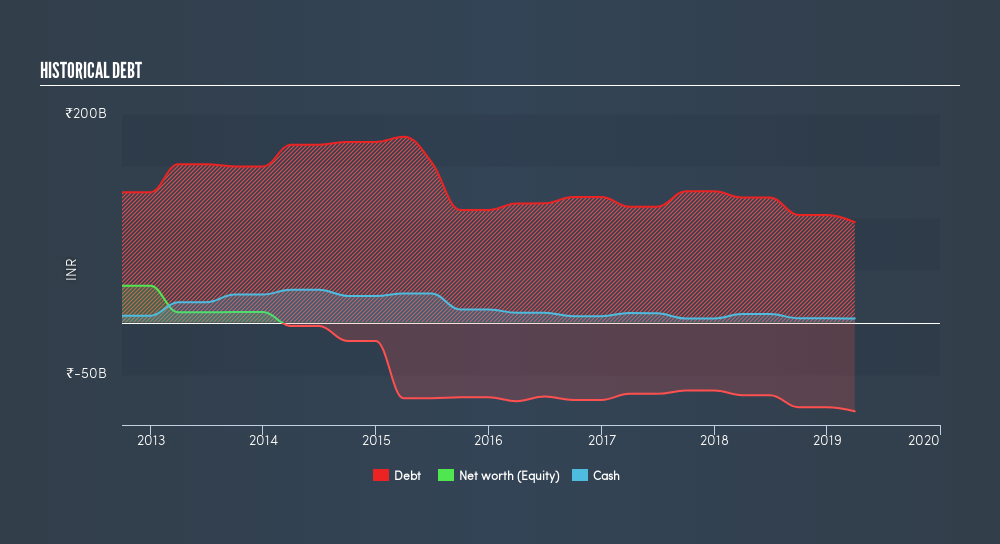

As you can see below, Suzlon Energy had ₹96.2b of debt at March 2019, down from ₹120.0b a year prior. However, it also had ₹3.91b in cash, and so its net debt is ₹92.3b.

How Healthy Is Suzlon Energy's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Suzlon Energy had liabilities of ₹109.5b due within 12 months and liabilities of ₹64.2b due beyond that. Offsetting this, it had ₹3.91b in cash and ₹19.1b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹150.7b.

This deficit casts a shadow over the ₹21.0b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Suzlon Energy would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Suzlon Energy can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Suzlon Energy saw its revenue drop to ₹50b, which is a fall of 40%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Suzlon Energy's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost ₹623m at the EBIT level. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it burned through ₹8.2b in the last year. So is this a high risk stock? We think so, and we'd avoid it like an anti-vaccine zealot with an obvious case of measles. For riskier companies like Suzlon Energy I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SUZLON

Suzlon Energy

Manufactures and sells wind turbine generators and related components in India and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives