- India

- /

- Electrical

- /

- NSEI:SPECTRUM

There's Reason For Concern Over Spectrum Electrical Industries Limited's (NSE:SPECTRUM) Massive 31% Price Jump

Spectrum Electrical Industries Limited (NSE:SPECTRUM) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 49%.

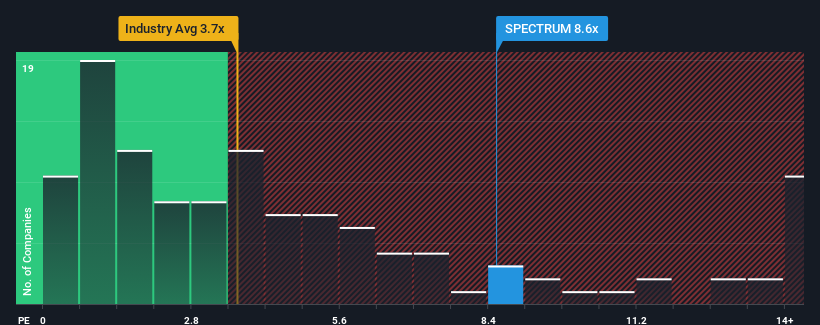

After such a large jump in price, Spectrum Electrical Industries may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.6x, when you consider almost half of the companies in the Electrical industry in India have P/S ratios under 3.7x and even P/S lower than 1.6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Spectrum Electrical Industries

How Spectrum Electrical Industries Has Been Performing

With revenue growth that's exceedingly strong of late, Spectrum Electrical Industries has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Spectrum Electrical Industries, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Spectrum Electrical Industries' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Spectrum Electrical Industries' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. The latest three year period has also seen an excellent 61% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Spectrum Electrical Industries' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to Spectrum Electrical Industries' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Spectrum Electrical Industries revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Spectrum Electrical Industries (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Spectrum Electrical Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SPECTRUM

Spectrum Electrical Industries

Designs, manufactures, and sells electrical, automobile, and irrigation components in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.