- India

- /

- Trade Distributors

- /

- NSEI:SIGIND

Signet Industries (NSE:SIGIND) Has Announced A Dividend Of ₹0.50

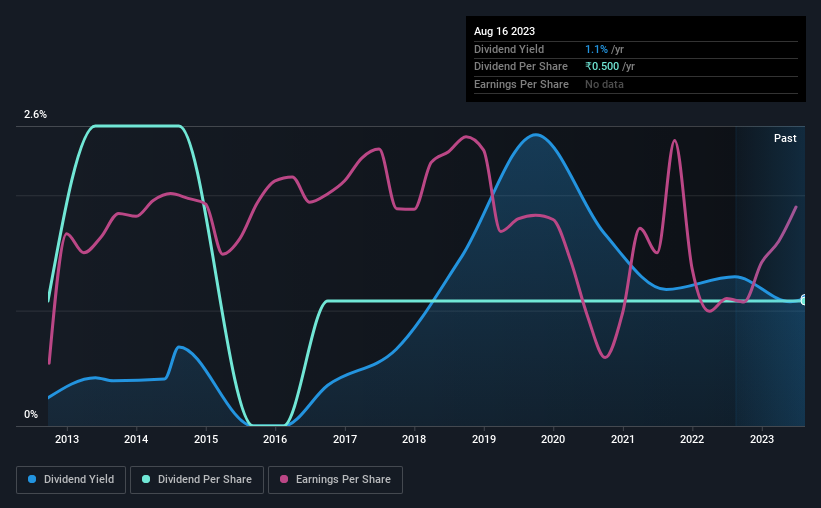

The board of Signet Industries Limited (NSE:SIGIND) has announced that it will pay a dividend of ₹0.50 per share on the 29th of October. Based on this payment, the dividend yield on the company's stock will be 1.1%, which is an attractive boost to shareholder returns.

View our latest analysis for Signet Industries

Signet Industries' Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, Signet Industries was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Unless the company can turn things around, EPS could fall by 4.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 9.4%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The most recent annual payment of ₹0.50 is about the same as the annual payment 10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Over the past five years, it looks as though Signet Industries' EPS has declined at around 4.7% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

Our Thoughts On Signet Industries' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 5 warning signs for Signet Industries (of which 2 are significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SIGIND

Signet Industries

Primarily engages in merchant trading of various polymer and plastic granules in India.

Good value slight.

Market Insights

Community Narratives