Thyagarajan Shivaraman became the CEO of Shriram EPC Limited (NSE:SHRIRAMEPC) in 2007, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Shriram EPC.

View our latest analysis for Shriram EPC

Comparing Shriram EPC Limited's CEO Compensation With the industry

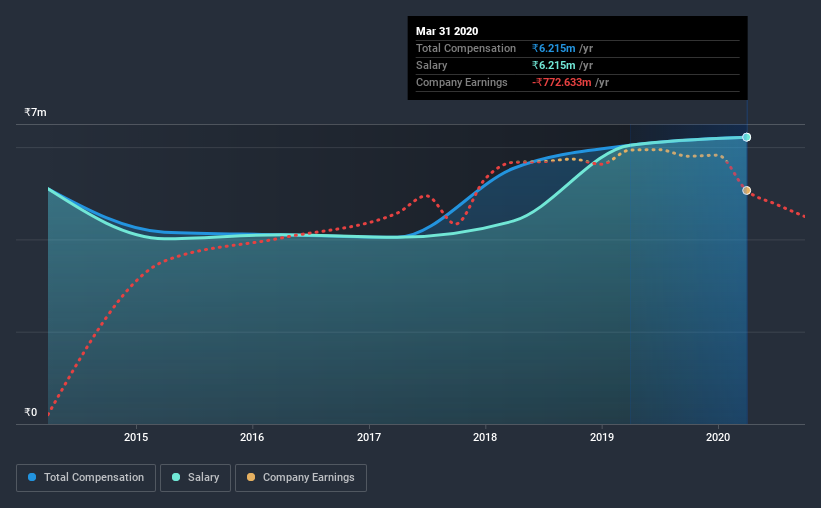

Our data indicates that Shriram EPC Limited has a market capitalization of ₹4.8b, and total annual CEO compensation was reported as ₹6.2m for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary of ₹6.2m is the entirety of the CEO compensation.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹4.8m. This suggests that Shriram EPC remunerates its CEO largely in line with the industry average. Moreover, Thyagarajan Shivaraman also holds ₹1.4m worth of Shriram EPC stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹6.2m | ₹6.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.2m | ₹6.0m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. Speaking on a company level, Shriram EPC prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Shriram EPC Limited's Growth

Over the last three years, Shriram EPC Limited has shrunk its earnings per share by 85% per year. In the last year, its revenue is down 46%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Shriram EPC Limited Been A Good Investment?

With a three year total loss of 83% for the shareholders, Shriram EPC Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Shriram EPC rewards its CEO solely through a salary, ignoring non-salary benefits completely. As previously discussed, Thyagarajan is compensated close to the median for companies of its size, and which belong to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Shriram EPC that investors should look into moving forward.

Switching gears from Shriram EPC, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Shriram EPC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SEPC

SEPC

Provides integrated design, engineering, procurement, construction, and project management services in India and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives