- India

- /

- Trade Distributors

- /

- NSEI:SHIVAUM

We Ran A Stock Scan For Earnings Growth And Shiv Aum Steels (NSE:SHIVAUM) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Shiv Aum Steels (NSE:SHIVAUM). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Shiv Aum Steels

How Quickly Is Shiv Aum Steels Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Shiv Aum Steels has grown EPS by 28% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

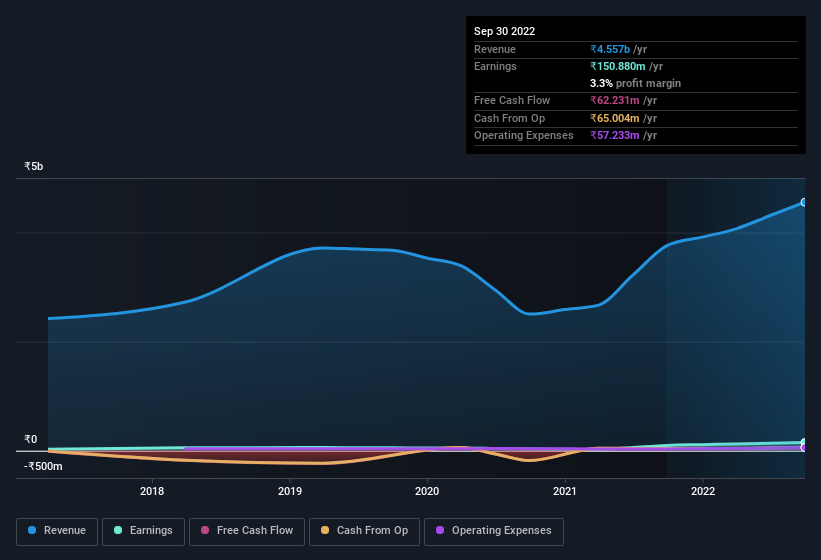

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Shiv Aum Steels achieved similar EBIT margins to last year, revenue grew by a solid 21% to ₹4.6b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Shiv Aum Steels isn't a huge company, given its market capitalisation of ₹2.8b. That makes it extra important to check on its balance sheet strength.

Are Shiv Aum Steels Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Shiv Aum Steels will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 50% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹1.4b at the current share price. That's nothing to sneeze at!

Does Shiv Aum Steels Deserve A Spot On Your Watchlist?

You can't deny that Shiv Aum Steels has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 3 warning signs for Shiv Aum Steels (of which 2 shouldn't be ignored!) you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHIVAUM

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives