After Leaping 32% Shaily Engineering Plastics Limited (NSE:SHAILY) Shares Are Not Flying Under The Radar

The Shaily Engineering Plastics Limited (NSE:SHAILY) share price has done very well over the last month, posting an excellent gain of 32%. The annual gain comes to 217% following the latest surge, making investors sit up and take notice.

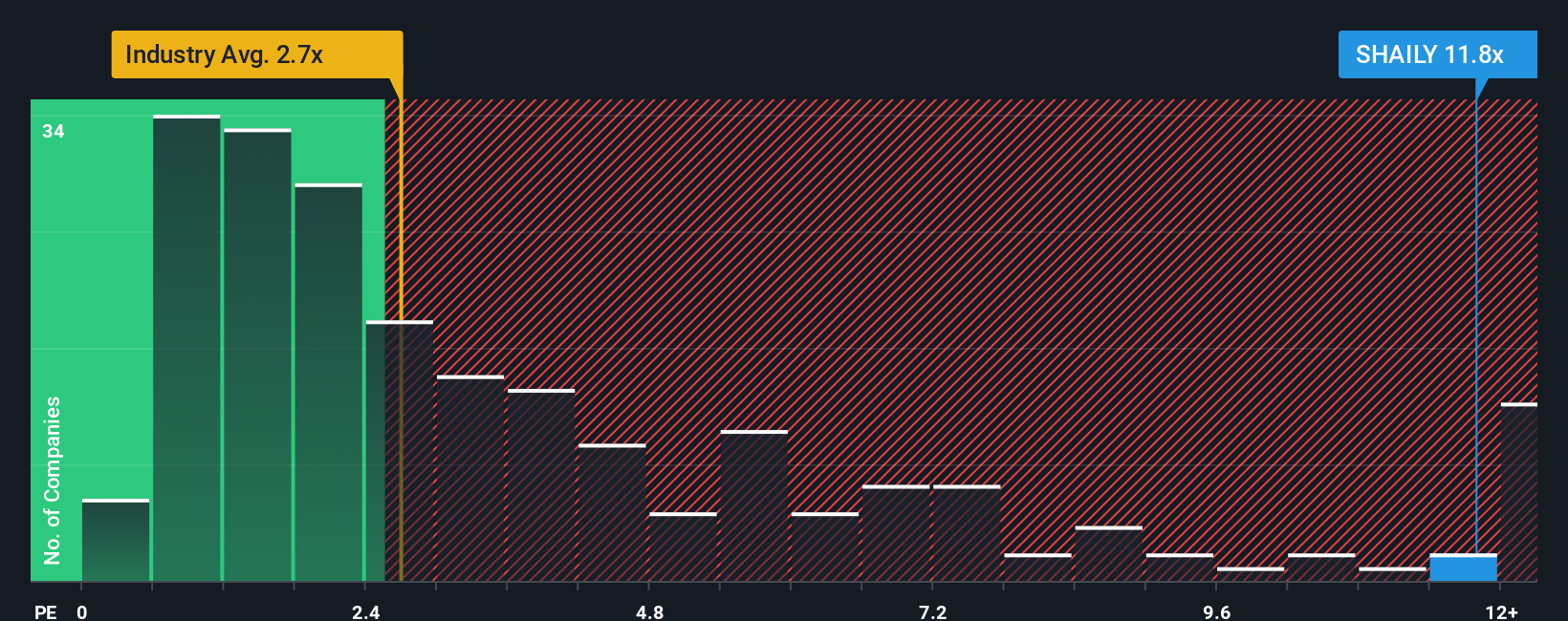

After such a large jump in price, given around half the companies in India's Machinery industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Shaily Engineering Plastics as a stock to avoid entirely with its 11.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shaily Engineering Plastics

What Does Shaily Engineering Plastics' P/S Mean For Shareholders?

Shaily Engineering Plastics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shaily Engineering Plastics.Is There Enough Revenue Growth Forecasted For Shaily Engineering Plastics?

The only time you'd be truly comfortable seeing a P/S as steep as Shaily Engineering Plastics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 39% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 55% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

In light of this, it's understandable that Shaily Engineering Plastics' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Shaily Engineering Plastics have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shaily Engineering Plastics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Shaily Engineering Plastics has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Shaily Engineering Plastics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHAILY

Shaily Engineering Plastics

Engages in the manufacture and sale of precision injection moulded plastic components/products in India.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives