Here's Why Rex Pipes and Cables Industries (NSE:REXPIPES) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Rex Pipes and Cables Industries (NSE:REXPIPES). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Rex Pipes and Cables Industries Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Rex Pipes and Cables Industries has managed to grow EPS by 35% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

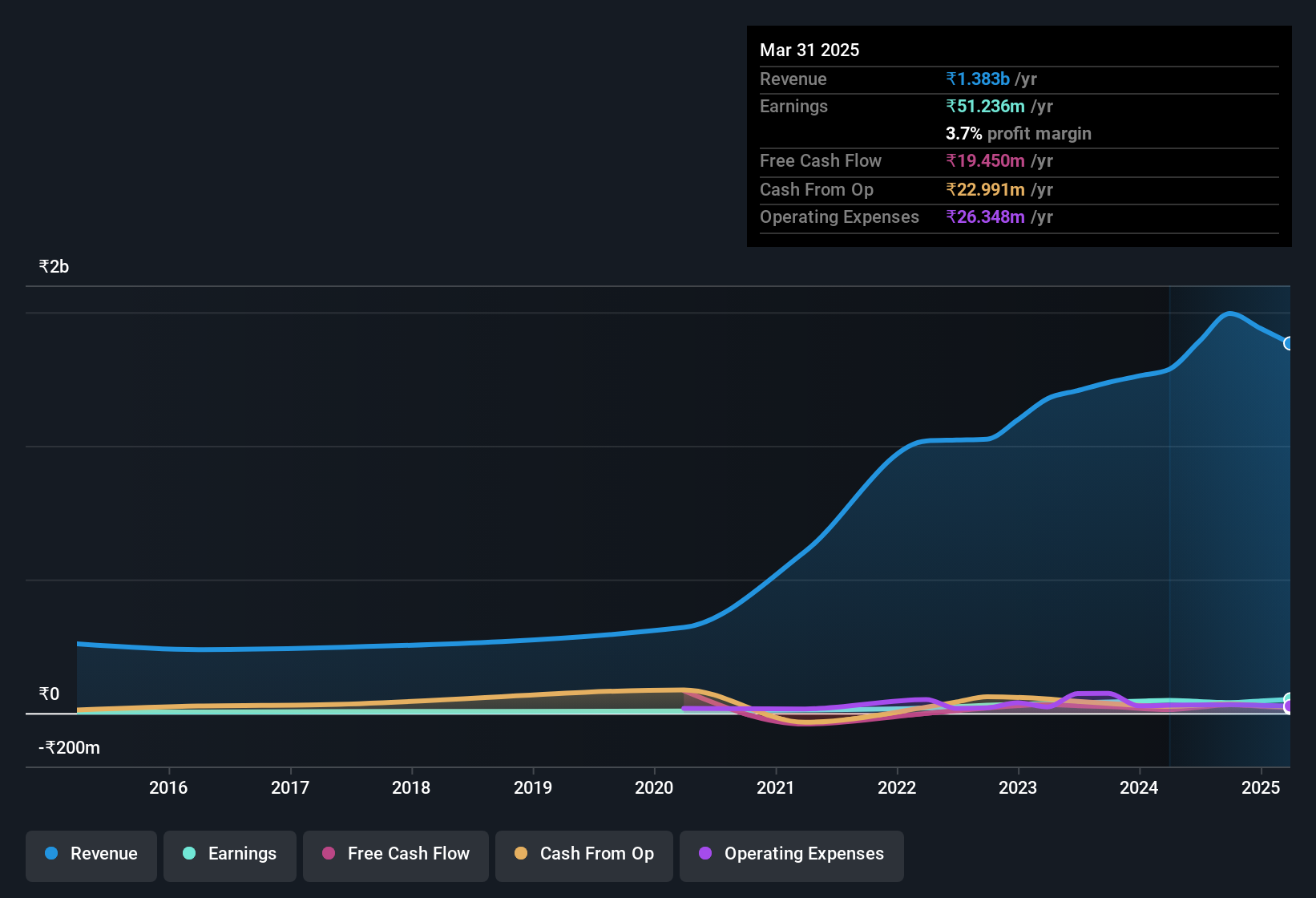

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Rex Pipes and Cables Industries achieved similar EBIT margins to last year, revenue grew by a solid 7.6% to ₹1.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for Rex Pipes and Cables Industries

Since Rex Pipes and Cables Industries is no giant, with a market capitalisation of ₹1.4b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Rex Pipes and Cables Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some Rex Pipes and Cables Industries insiders disposing of some shares, we note that there was ₹4.6m more in buying interest among those who know the company best On balance, that's a good sign. We also note that it was the Whole Time Director, Rajendra Kaler, who made the biggest single acquisition, paying ₹505k for shares at about ₹64.84 each.

Recent insider purchases of Rex Pipes and Cables Industries stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Rex Pipes and Cables Industries, with market caps under ₹17b is around ₹3.6m.

The Rex Pipes and Cables Industries CEO received total compensation of only ₹2.0m in the year to March 2024. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Rex Pipes and Cables Industries Deserve A Spot On Your Watchlist?

You can't deny that Rex Pipes and Cables Industries has grown its earnings per share at a very impressive rate. That's attractive. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. The overriding message from this quick rundown is yes, this stock is worth investigating further. You should always think about risks though. Case in point, we've spotted 2 warning signs for Rex Pipes and Cables Industries you should be aware of, and 1 of them makes us a bit uncomfortable.

Keen growth investors love to see insider activity. Thankfully, Rex Pipes and Cables Industries isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REXPIPES

Rex Pipes and Cables Industries

Manufactures and sells pipes and cable related accessories in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success