- India

- /

- Electrical

- /

- NSEI:RAMRAT

Ram Ratna Wires Limited's (NSE:RAMRAT) 32% Price Boost Is Out Of Tune With Earnings

Despite an already strong run, Ram Ratna Wires Limited (NSE:RAMRAT) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 85%.

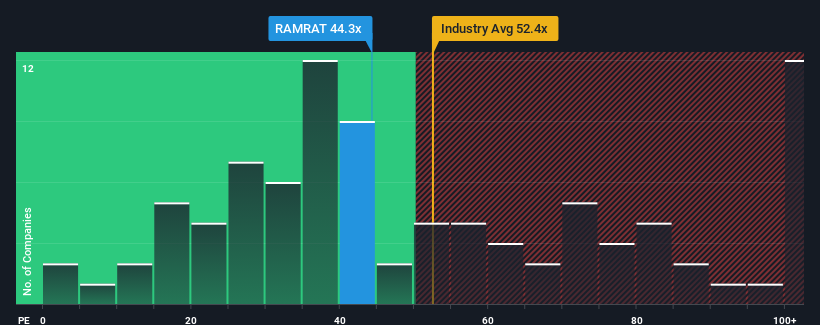

After such a large jump in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 34x, you may consider Ram Ratna Wires as a stock to potentially avoid with its 44.3x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Ram Ratna Wires over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Ram Ratna Wires

Does Growth Match The High P/E?

Ram Ratna Wires' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. Pleasingly, EPS has also lifted 108% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 26% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Ram Ratna Wires is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Ram Ratna Wires shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Ram Ratna Wires revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Ram Ratna Wires (1 is a bit unpleasant!) that you should be aware of.

Of course, you might also be able to find a better stock than Ram Ratna Wires. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAMRAT

Ram Ratna Wires

Manufactures and sells winding wires and related insulated products for original equipment manufacturers in India.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives