- India

- /

- Electrical

- /

- NSEI:POWERINDIA

Hitachi Energy India Limited's (NSE:POWERINDIA) Shares Climb 27% But Its Business Is Yet to Catch Up

Despite an already strong run, Hitachi Energy India Limited (NSE:POWERINDIA) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 159% following the latest surge, making investors sit up and take notice.

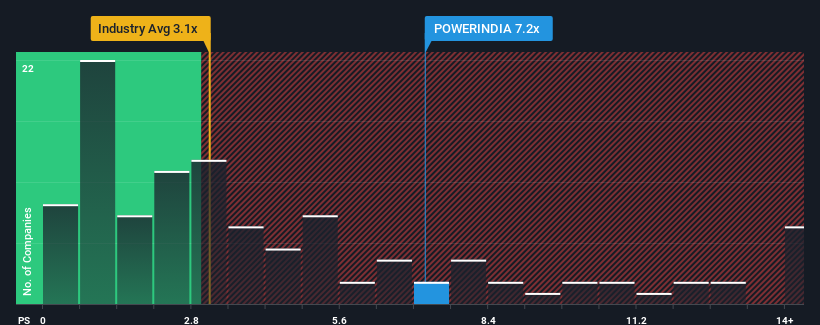

Following the firm bounce in price, when almost half of the companies in India's Electrical industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Hitachi Energy India as a stock not worth researching with its 7.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hitachi Energy India

What Does Hitachi Energy India's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Hitachi Energy India has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hitachi Energy India will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Hitachi Energy India's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 43% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 27% as estimated by the seven analysts watching the company. That's shaping up to be similar to the 30% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Hitachi Energy India's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Hitachi Energy India's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Hitachi Energy India's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hitachi Energy India with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hitachi Energy India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POWERINDIA

Hitachi Energy India

Offers products, projects, and services for electricity transmission and related activities in India and internationally.

Exceptional growth potential with excellent balance sheet.