Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Polycab India Limited (NSE:POLYCAB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Polycab India

What Is Polycab India's Net Debt?

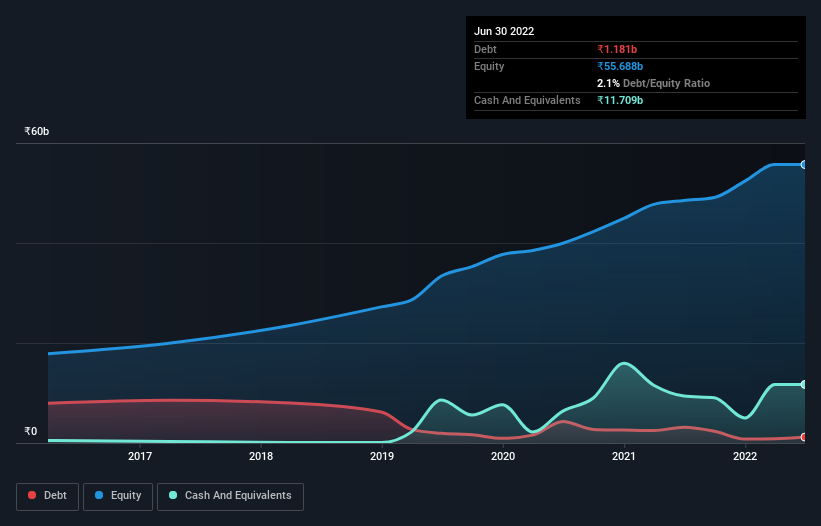

The image below, which you can click on for greater detail, shows that Polycab India had debt of ₹1.18b at the end of March 2022, a reduction from ₹3.17b over a year. But on the other hand it also has ₹11.7b in cash, leading to a ₹10.5b net cash position.

A Look At Polycab India's Liabilities

Zooming in on the latest balance sheet data, we can see that Polycab India had liabilities of ₹17.4b due within 12 months and liabilities of ₹1.02b due beyond that. Offsetting these obligations, it had cash of ₹11.7b as well as receivables valued at ₹13.3b due within 12 months. So it actually has ₹6.55b more liquid assets than total liabilities.

Having regard to Polycab India's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹333.6b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Polycab India boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Polycab India grew its EBIT by 18% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Polycab India can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Polycab India has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Polycab India created free cash flow amounting to 15% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Polycab India has net cash of ₹10.5b, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 18% over the last year. So we are not troubled with Polycab India's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Polycab India you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POLYCAB

Polycab India

Manufactures and sells wires and cables under the POLYCAB brand in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives