- India

- /

- Electrical

- /

- NSEI:PITTIENG

Shareholders Are Thrilled That The Pitti Engineering (NSE:PITTIENG) Share Price Increased 103%

Pitti Engineering Limited (NSE:PITTIENG) shareholders might be concerned after seeing the share price drop 17% in the last month. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 103% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Pitti Engineering

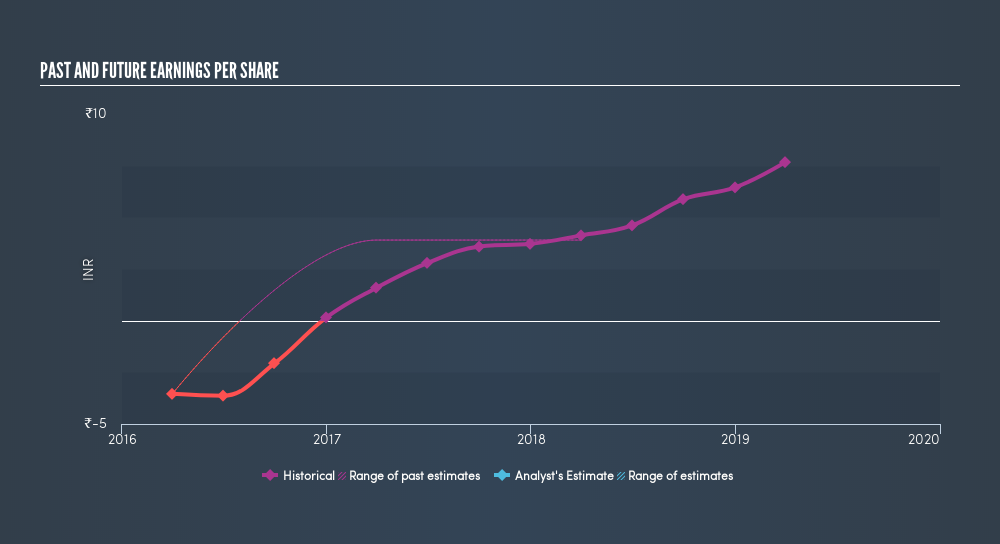

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Pitti Engineering moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Pitti Engineering's key metrics by checking this interactive graph of Pitti Engineering's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Pitti Engineering's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Pitti Engineering shareholders, and that cash payout contributed to why its TSR of 111%, over the last 5 years, is better than the share price return.

A Different Perspective

We regret to report that Pitti Engineering shareholders are down 53% for the year. Unfortunately, that's worse than the broader market decline of 4.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 16% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before deciding if you like the current share price, check how Pitti Engineering scores on these 3 valuation metrics.

But note: Pitti Engineering may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:PITTIENG

Pitti Engineering

Manufactures and sells iron and steel engineering products in India.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives