In a week marked by busy earnings reports and mixed economic data, small-cap stocks showed resilience compared to their larger counterparts, even as major indices like the S&P 500 and Nasdaq Composite experienced declines. Amidst this backdrop of cautious market sentiment and fluctuating labor signals, investors may find opportunities in companies with strong fundamentals that are not yet widely recognized. Identifying such undiscovered gems involves looking for robust financial health and growth potential that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

MIA Teknoloji Anonim Sirketi (IBSE:MIATK)

Simply Wall St Value Rating: ★★★★☆☆

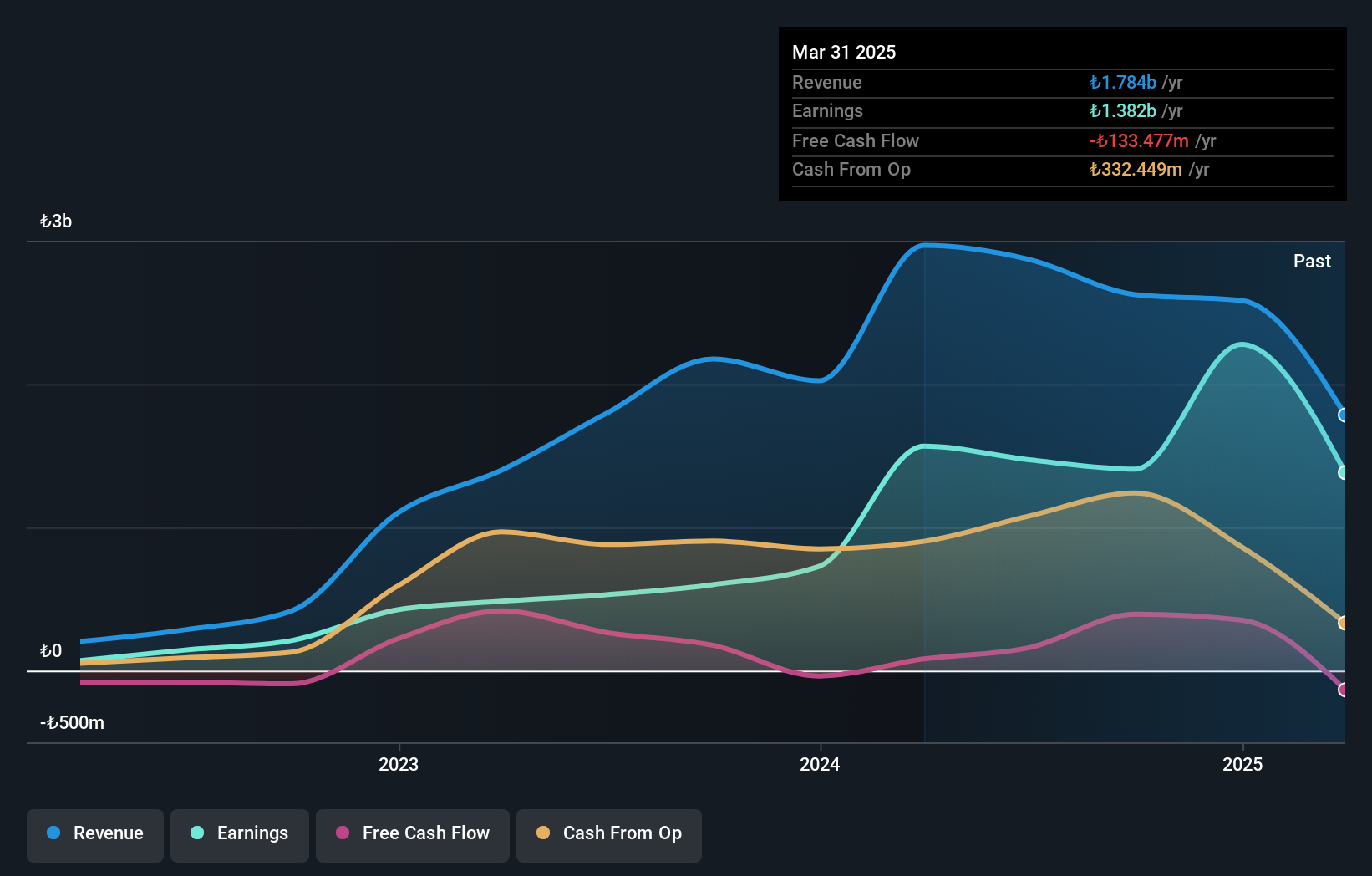

Overview: MIA Teknoloji Anonim Sirketi specializes in providing software development services to public and private organizations in Turkey, with a market capitalization of TRY21.71 billion.

Operations: MIA Teknoloji generates revenue primarily from its software and programming segment, amounting to TRY1.92 billion.

MIA Teknoloji has demonstrated robust earnings growth, with a 96% increase over the past year, outpacing the Software industry's 12%. Despite a recent TRY 29.99 million net loss in Q2 compared to last year's TRY 109.8 million profit, six-month figures show net income at TRY 696.34 million versus TRY 194.98 million previously. The company maintains a strong financial position with cash exceeding total debt and interest payments well-covered by EBIT at a ratio of 10.1x. Its price-to-earnings ratio of 21.6x suggests good value against the industry average of 64.1x, indicating potential for future growth despite recent setbacks.

D. B (NSEI:DBCORP)

Simply Wall St Value Rating: ★★★★★★

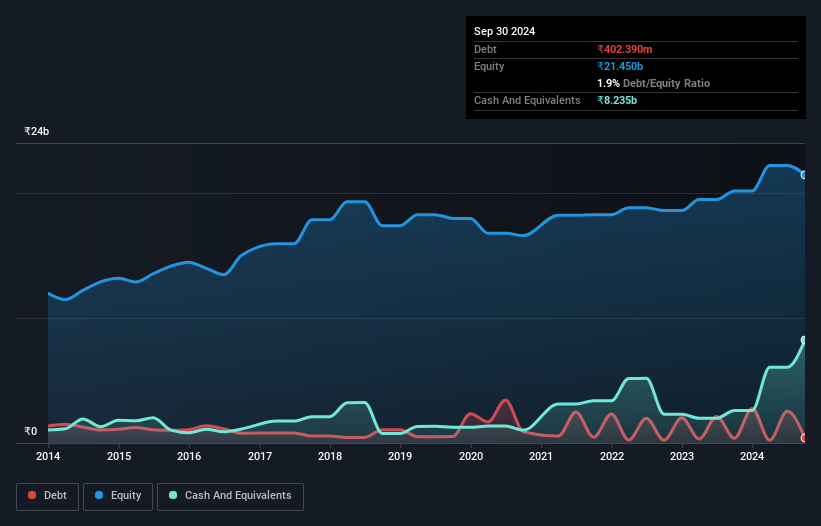

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management across India and internationally, with a market capitalization of ₹57.78 billion.

Operations: D. B. Corp Limited generates revenue primarily from its printing, publishing, and allied business segment, which contributes ₹22.44 billion, followed by the radio segment at ₹1.67 billion.

D. B. Corp, a media company with a knack for quality earnings, has been making waves with its impressive 66.6% earnings growth over the past year, outpacing the industry average of 33%. The company's debt-to-equity ratio improved from 2.9% to 1.9% in five years, highlighting prudent financial management alongside its positive free cash flow status. Recent results show sales at ₹5,589 million for Q2 2024 compared to ₹5,860 million last year and net income of ₹826 million versus ₹1,003 million previously; however, six-month figures reveal an increase in net income from ₹1,790 million to ₹2 billion.

- Navigate through the intricacies of D. B with our comprehensive health report here.

Assess D. B's past performance with our detailed historical performance reports.

Marine Electricals (India) (NSEI:MARINE)

Simply Wall St Value Rating: ★★★★☆☆

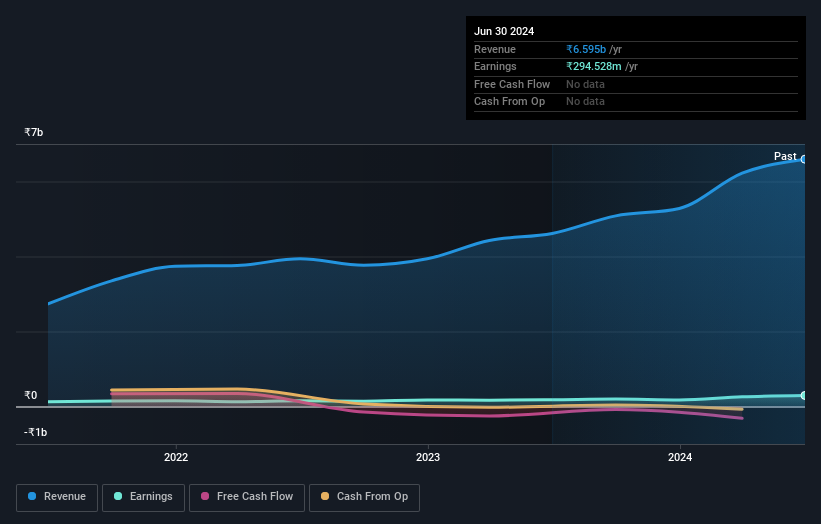

Overview: Marine Electricals (India) Limited is engaged in the manufacturing and sale of marine and industrial electrical and electronic components both domestically and internationally, with a market capitalization of ₹28.87 billion.

Operations: Marine Electricals generates revenue primarily from two segments: marine and industry, with the marine segment contributing ₹3.57 billion and the industry segment adding ₹3.03 billion.

Marine Electricals (India) is making waves with its impressive earnings growth of 64.1% over the past year, outpacing the electrical industry average of 36%. This small yet dynamic company has a net debt to equity ratio at a satisfactory level of 28.9%, indicating prudent financial management despite an increase from 32.2% to 38% over five years. Recent expansion efforts include opening a new plant in Goa, boosting manufacturing capacity by 20%. Although free cash flow remains negative, high-quality earnings and well-covered interest payments (3.4x EBIT) reinforce Marine's solid financial footing amidst ongoing business opportunities and regulatory challenges.

- Click to explore a detailed breakdown of our findings in Marine Electricals (India)'s health report.

Key Takeaways

- Investigate our full lineup of 4741 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MIATK

MIA Teknoloji Anonim Sirketi

Mia Teknoloji Anonim Sirketi provides software development services to public and private organizations in Turkey.

Excellent balance sheet with questionable track record.