- India

- /

- Construction

- /

- NSEI:MANINDS

With EPS Growth And More, Man Industries (India) (NSE:MANINDS) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Man Industries (India) (NSE:MANINDS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Man Industries (India)

How Fast Is Man Industries (India) Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Man Industries (India) has grown EPS by 21% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

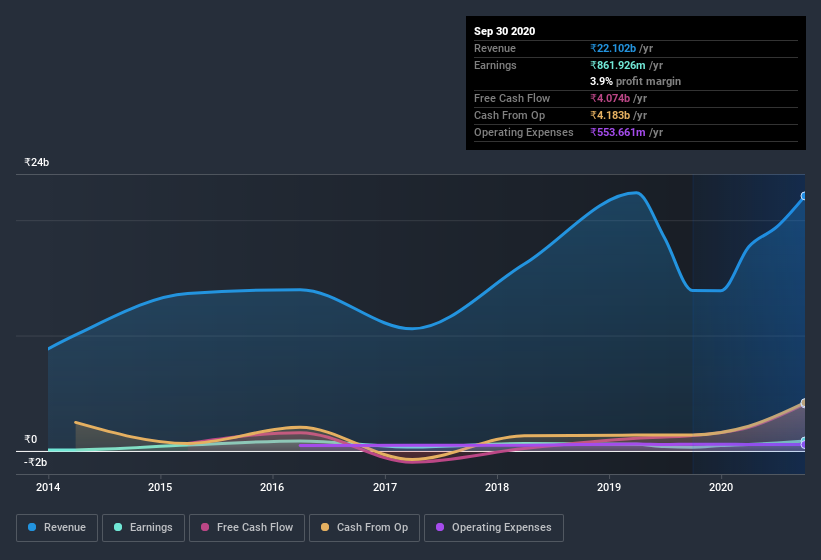

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Man Industries (India)'s revenue last year was revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Man Industries (India)'s EBIT margins were flat over the last year, revenue grew by a solid 59% to ₹22b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Man Industries (India) isn't a huge company, given its market capitalization of ₹4.1b. That makes it extra important to check on its balance sheet strength.

Are Man Industries (India) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Man Industries (India), is that company insiders paid ₹3.0m for shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. It is also worth noting that it was Executive Chairman Ramesh Mansukhani who made the biggest single purchase, worth ₹1.7m, paying ₹34.47 per share.

On top of the insider buying, we can also see that Man Industries (India) insiders own a large chunk of the company. In fact, they own 41% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about ₹1.7b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Man Industries (India) Worth Keeping An Eye On?

You can't deny that Man Industries (India) has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 3 warning signs for Man Industries (India) (1 doesn't sit too well with us!) that we have uncovered.

The good news is that Man Industries (India) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Man Industries (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MANINDS

Man Industries (India)

Manufactures, processes, and trades in submerged arc welded pipes and steel products in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives