- India

- /

- Construction

- /

- NSEI:MANINDS

Man Industries (India) Limited's (NSE:MANINDS) Shares Bounce 30% But Its Business Still Trails The Market

Man Industries (India) Limited (NSE:MANINDS) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days were the cherry on top of the stock's 355% gain in the last year, which is nothing short of spectacular.

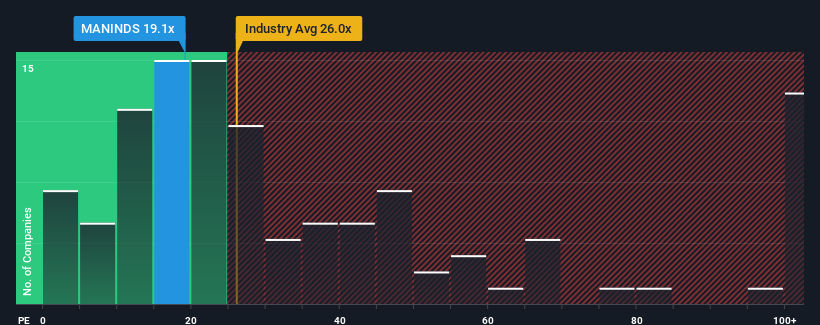

Even after such a large jump in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Man Industries (India) as an attractive investment with its 19.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Man Industries (India) has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Man Industries (India)

How Is Man Industries (India)'s Growth Trending?

In order to justify its P/E ratio, Man Industries (India) would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 78% last year. As a result, it also grew EPS by 25% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 17% per year during the coming three years according to the only analyst following the company. That's shaping up to be materially lower than the 19% per year growth forecast for the broader market.

With this information, we can see why Man Industries (India) is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Man Industries (India)'s stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Man Industries (India)'s analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Man Industries (India) that you need to take into consideration.

If these risks are making you reconsider your opinion on Man Industries (India), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MANINDS

Man Industries (India)

Manufactures, processes, and trades in submerged arc welded pipes and steel products in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives