Here's Why Mahindra EPC Irrigation (NSE:MAHEPC) Can Afford Some Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Mahindra EPC Irrigation Limited (NSE:MAHEPC) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Mahindra EPC Irrigation

What Is Mahindra EPC Irrigation's Net Debt?

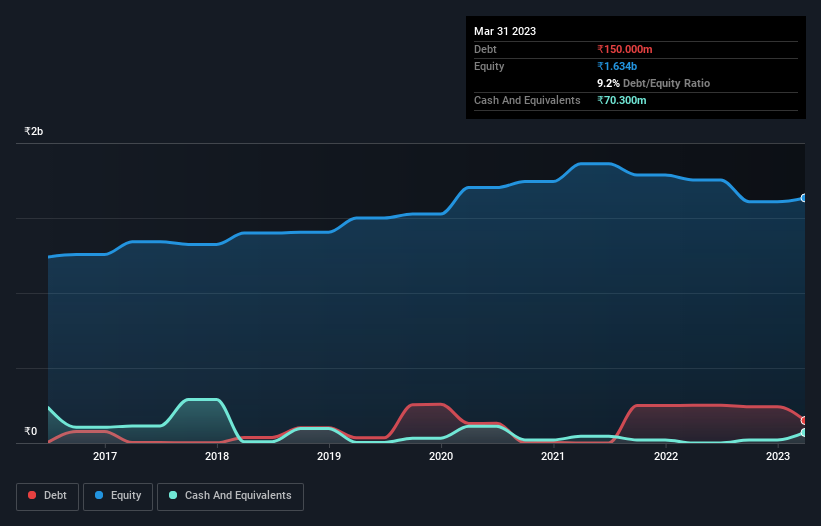

The image below, which you can click on for greater detail, shows that Mahindra EPC Irrigation had debt of ₹150.0m at the end of March 2023, a reduction from ₹251.9m over a year. However, it also had ₹70.3m in cash, and so its net debt is ₹79.7m.

A Look At Mahindra EPC Irrigation's Liabilities

According to the last reported balance sheet, Mahindra EPC Irrigation had liabilities of ₹892.5m due within 12 months, and liabilities of ₹5.20m due beyond 12 months. Offsetting these obligations, it had cash of ₹70.3m as well as receivables valued at ₹1.14b due within 12 months. So it can boast ₹310.0m more liquid assets than total liabilities.

This surplus suggests that Mahindra EPC Irrigation has a conservative balance sheet, and could probably eliminate its debt without much difficulty. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Mahindra EPC Irrigation will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Mahindra EPC Irrigation saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Mahindra EPC Irrigation produced an earnings before interest and tax (EBIT) loss. Indeed, it lost ₹135m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But a profit would do more to inspire us to research the business more closely. So it seems too risky for our taste. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Mahindra EPC Irrigation (of which 1 is a bit concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Mahindra EPC Irrigation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHEPC

Mahindra EPC Irrigation

Manufactures, sells, and markets micro irrigation systems in India and Uganda.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives