- India

- /

- Electrical

- /

- NSEI:KEL

Why We're Not Concerned About Kundan Edifice Limited's (NSE:KEL) Share Price

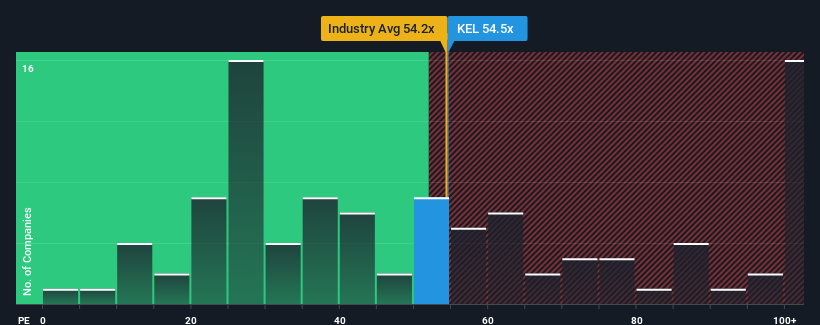

With a price-to-earnings (or "P/E") ratio of 54.5x Kundan Edifice Limited (NSE:KEL) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 32x and even P/E's lower than 19x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Kundan Edifice over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Kundan Edifice

Is There Enough Growth For Kundan Edifice?

The only time you'd be truly comfortable seeing a P/E as steep as Kundan Edifice's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. Still, the latest three year period has seen an excellent 176% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 26% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Kundan Edifice is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Kundan Edifice revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for Kundan Edifice (2 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Kundan Edifice, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kundan Edifice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KEL

Kundan Edifice

Designs, develops, manufactures, assemblies, supplies, and sells light emitting diode (LED) strip lights primarily in India.

Slight with imperfect balance sheet.

Market Insights

Community Narratives