- India

- /

- Construction

- /

- NSEI:JMCPROJECT

How Should Investors React To JMC Projects (India) Limited's (NSE:JMCPROJECT) CEO Pay?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Shailendra Tripathi became the CEO of JMC Projects (India) Limited (NSE:JMCPROJECT) in 2013. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for JMC Projects (India)

How Does Shailendra Tripathi's Compensation Compare With Similar Sized Companies?

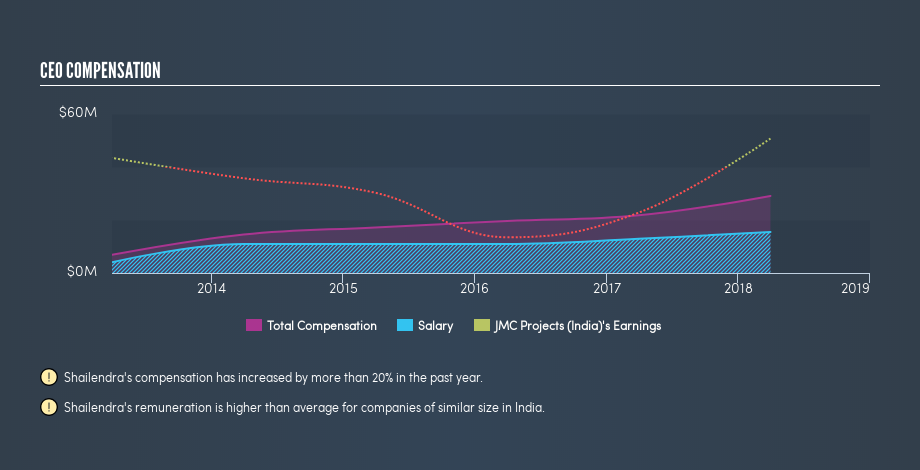

Our data indicates that JMC Projects (India) Limited is worth ₹19b, and total annual CEO compensation is ₹29m. (This number is for the twelve months until March 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at ₹16m. When we examined a selection of companies with market caps ranging from ₹7.0b to ₹28b, we found the median CEO total compensation was ₹16m.

It would therefore appear that JMC Projects (India) Limited pays Shailendra Tripathi more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

The graphic below shows how CEO compensation at JMC Projects (India) has changed from year to year.

Is JMC Projects (India) Limited Growing?

On average over the last three years, JMC Projects (India) Limited has grown earnings per share (EPS) by 96% each year (using a line of best fit). It achieved revenue growth of 19% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. Shareholders might be interested in this free visualization of analyst forecasts.

Has JMC Projects (India) Limited Been A Good Investment?

Most shareholders would probably be pleased with JMC Projects (India) Limited for providing a total return of 112% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

We examined the amount JMC Projects (India) Limited pays its CEO, and compared it to the amount paid by similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

However, the earnings per share growth over three years is certainly impressive. In addition, shareholders have done well over the same time period. So, considering this good performance, the CEO compensation may be quite appropriate. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling JMC Projects (India) (free visualization of insider trades).

If you want to buy a stock that is better than JMC Projects (India), this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:JMCPROJECT

JMC Projects (India)

JMC Projects (India) Limited engages in the business of engineering, procurement, and construction relating to infrastructure sector in India, Ethiopia, Sri Lanka, and Mongolia.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026