- India

- /

- Construction

- /

- NSEI:IRB

IRB Infrastructure Developers Limited's (NSE:IRB) Earnings Haven't Escaped The Attention Of Investors

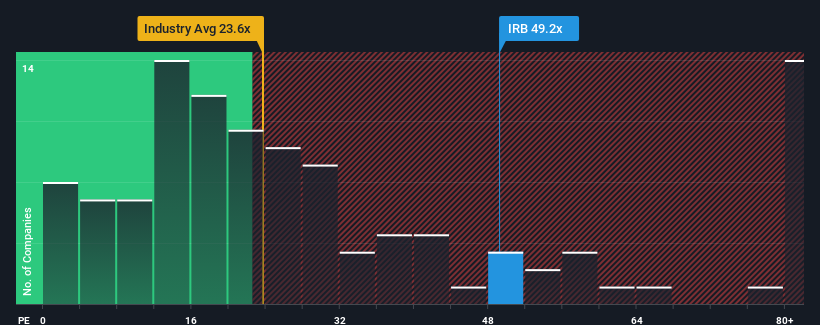

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 29x, you may consider IRB Infrastructure Developers Limited (NSE:IRB) as a stock to avoid entirely with its 49.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

IRB Infrastructure Developers hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for IRB Infrastructure Developers

Is There Enough Growth For IRB Infrastructure Developers?

IRB Infrastructure Developers' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. Regardless, EPS has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 33% each year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that IRB Infrastructure Developers' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that IRB Infrastructure Developers maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - IRB Infrastructure Developers has 3 warning signs (and 1 which is concerning) we think you should know about.

You might be able to find a better investment than IRB Infrastructure Developers. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRB

IRB Infrastructure Developers

Engages in the infrastructure development business in India.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026