Market Participants Recognise INOX India Limited's (NSE:INOXINDIA) Earnings Pushing Shares 26% Higher

INOX India Limited (NSE:INOXINDIA) shares have continued their recent momentum with a 26% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

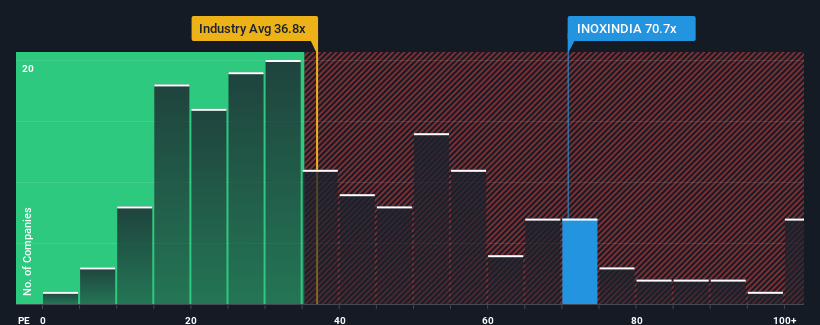

Following the firm bounce in price, INOX India may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 70.7x, since almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for INOX India has been in line with the market. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for INOX India

How Is INOX India's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like INOX India's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's bottom line. The latest three year period has also seen an excellent 87% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 28% as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we can see why INOX India is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

INOX India's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that INOX India maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for INOX India you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INOXINDIA

INOX India

Manufactures and supplies cryogenic liquid storage and transport tanks for gas companies and other customers in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives