Stock Analysis

- India

- /

- Transportation

- /

- NSEI:VRLLOG

HEG Leads Trio Of Value Stocks On Indian Exchange Based On Estimated Valuations

Reviewed by Simply Wall St

The Indian stock market has shown robust performance, appreciating by 44% over the past year and gaining 1.0% in just the last week, with earnings expected to grow by 16% annually. In such a thriving market environment, identifying undervalued stocks like HEG can offer investors potential opportunities for value-based growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Updater Services (NSEI:UDS) | ₹291.45 | ₹476.56 | 38.8% |

| Allied Digital Services (NSEI:ADSL) | ₹160.79 | ₹229.55 | 30% |

| Vedanta (NSEI:VEDL) | ₹469.95 | ₹642.01 | 26.8% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹479.85 | ₹803.95 | 40.3% |

| Strides Pharma Science (NSEI:STAR) | ₹948.30 | ₹1520.38 | 37.6% |

| TV18 Broadcast (NSEI:TV18BRDCST) | ₹42.69 | ₹70.18 | 39.2% |

| PVR INOX (NSEI:PVRINOX) | ₹1383.75 | ₹2202.55 | 37.2% |

| Delhivery (NSEI:DELHIVERY) | ₹400.45 | ₹613.54 | 34.7% |

| Camlin Fine Sciences (BSE:532834) | ₹111.18 | ₹157.50 | 29.4% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3010.60 | ₹4552.68 | 33.9% |

Underneath we present a selection of stocks filtered out by our screen

HEG (NSEI:HEG)

Overview: HEG Limited is a company that specializes in manufacturing and selling graphite electrodes, operating both in India and internationally, with a market cap of approximately ₹89.55 billion.

Operations: The firm generates revenue primarily through its graphite segment, which accounted for ₹23.61 billion, and a smaller contribution from the power segment at ₹0.34 billion.

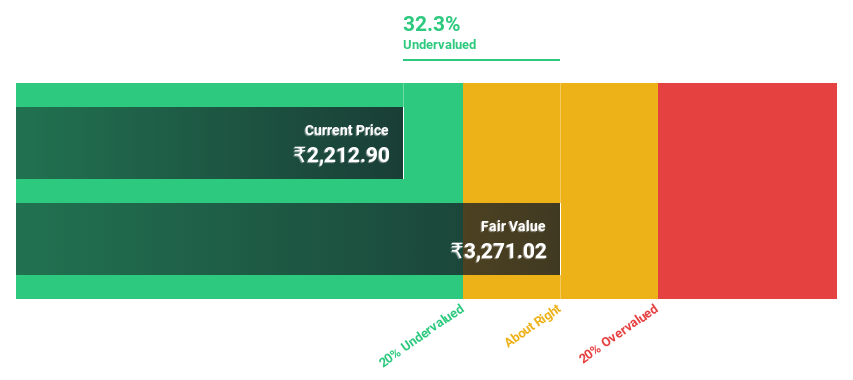

Estimated Discount To Fair Value: 18.4%

HEG Limited, priced at ₹2320.2, trades below the estimated fair value of ₹2844.14, indicating potential undervaluation based on discounted cash flow analysis. Despite a recent dip in net income and earnings per share as reported in Q4 2024, HEG is poised for robust growth with expected annual profit surges of 42.58% and revenue increases of 22.3%, both outpacing the broader Indian market projections significantly. However, its dividend track record remains unstable amidst this aggressive expansion phase marked by the formation of HEG Graphite Limited to enhance graphite electrode manufacturing capacities.

- According our earnings growth report, there's an indication that HEG might be ready to expand.

- Unlock comprehensive insights into our analysis of HEG stock in this financial health report.

Mahindra Logistics (NSEI:MAHLOG)

Overview: Mahindra Logistics Limited operates in India and internationally, offering integrated logistics and mobility solutions with a market capitalization of approximately ₹34.57 billion.

Operations: The company generates revenue primarily from two segments: Supply Chain Management (₹51.78 billion) and Enterprise Mobility Services (₹3.28 billion).

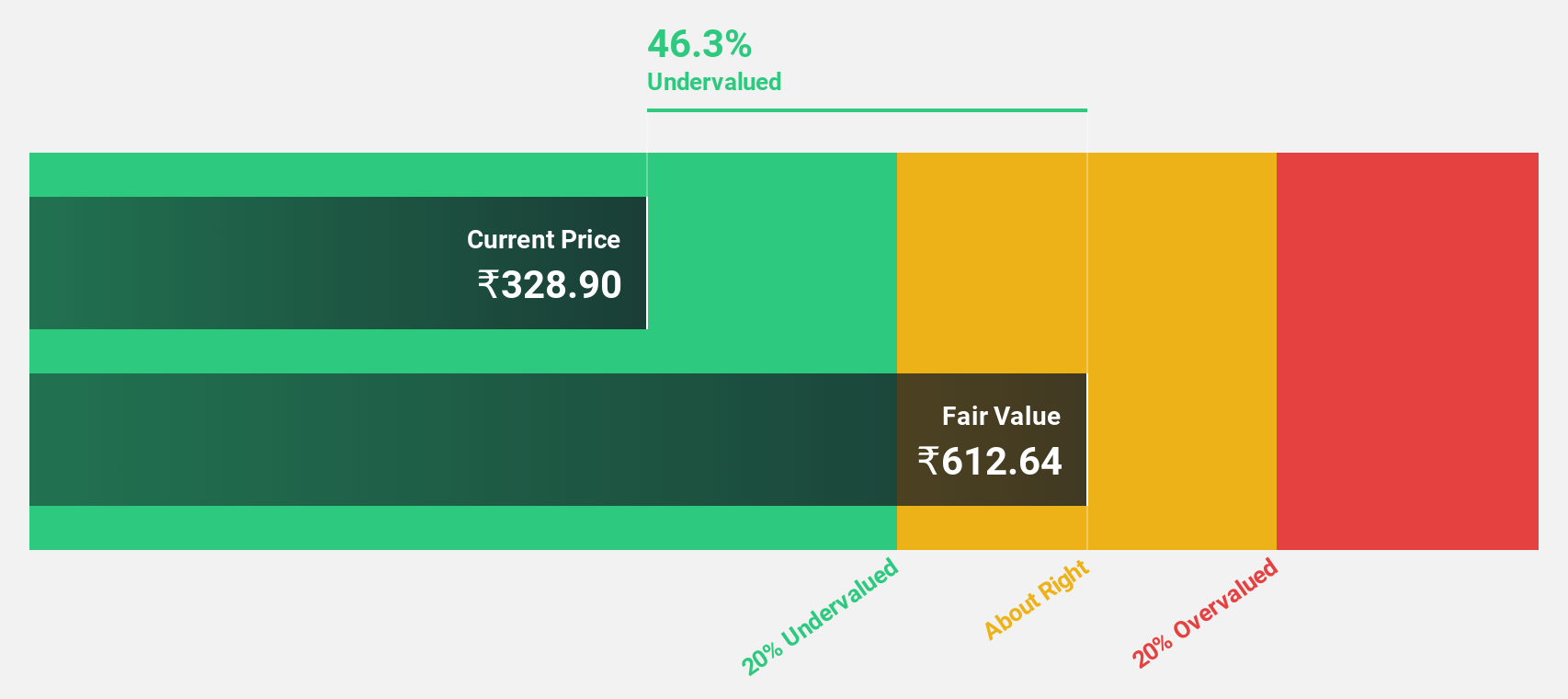

Estimated Discount To Fair Value: 40.3%

Mahindra Logistics, valued at ₹479.85, is perceived as undervalued with its price 40.3% below the fair value of ₹803.95 based on cash flow analysis. Despite a challenging fiscal year with a significant net loss reported in Q4 2024, the company is forecasted to return to profitability within three years, outpacing average market growth expectations. Recent strategic moves include forming a joint venture focused on warehousing and trucking for Japanese auto firms in India, potentially bolstering future revenue streams which are expected to grow faster than the broader Indian market at 11.8% annually.

- The growth report we've compiled suggests that Mahindra Logistics' future prospects could be on the up.

- Take a closer look at Mahindra Logistics' balance sheet health here in our report.

VRL Logistics (NSEI:VRLLOG)

Overview: VRL Logistics Limited is a logistics and transport company with operations in India and internationally, boasting a market cap of approximately ₹49.27 billion.

Operations: The primary revenue stream is generated from goods transport, contributing approximately ₹29.10 billion.

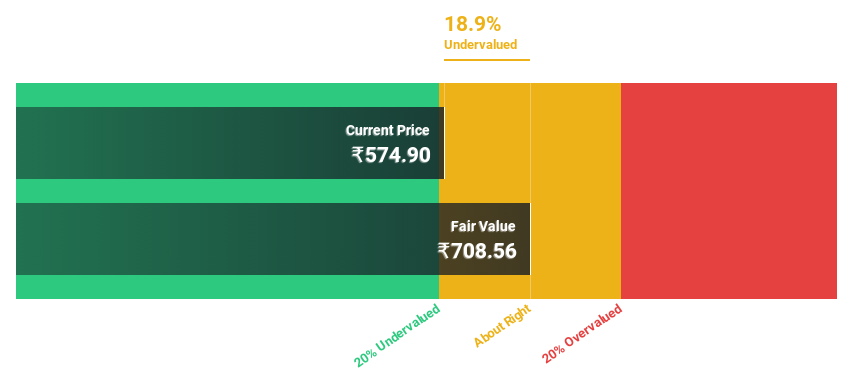

Estimated Discount To Fair Value: 10.2%

VRL Logistics, currently priced at ₹563.25, trades 10.2% under its calculated fair value of ₹627.41, indicating potential undervaluation based on cash flows. Despite recent earnings volatility with a significant drop in net income and EPS in Q4 2024 compared to the previous year, analysts project robust annual earnings growth of 30.5%, outstripping the Indian market's forecasted 15.9%. However, concerns linger over its unstable dividend track record and declining profit margins from 6.3% to 3.1%.

- Upon reviewing our latest growth report, VRL Logistics' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of VRL Logistics.

Next Steps

- Click this link to deep-dive into the 16 companies within our Undervalued Indian Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether VRL Logistics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VRLLOG

VRL Logistics

Operates as a logistics and transport company in India and internationally.

High growth potential second-rate dividend payer.