- India

- /

- Construction

- /

- NSEI:HECPROJECT

Should You Be Adding HEC Infra Projects (NSE:HECPROJECT) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like HEC Infra Projects (NSE:HECPROJECT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide HEC Infra Projects with the means to add long-term value to shareholders.

View our latest analysis for HEC Infra Projects

HEC Infra Projects' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, HEC Infra Projects has achieved impressive annual EPS growth of 42%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

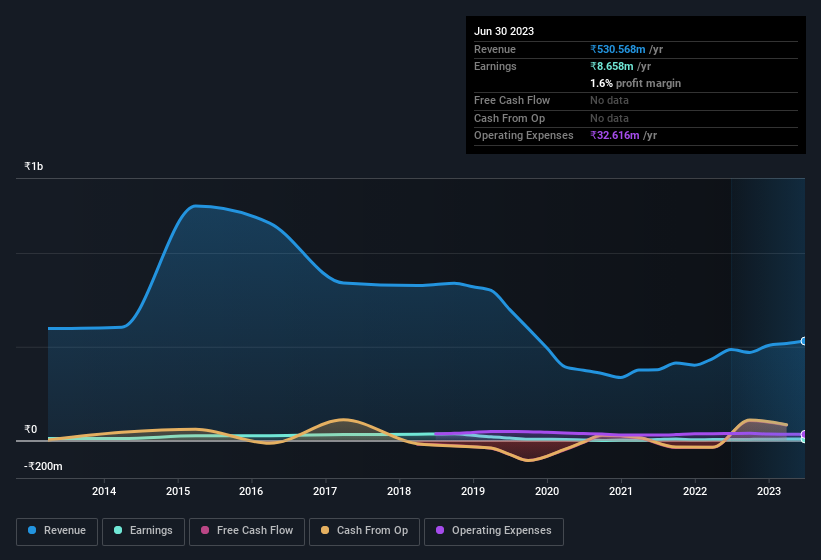

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for HEC Infra Projects remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.2% to ₹531m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since HEC Infra Projects is no giant, with a market capitalisation of ₹450m, you should definitely check its cash and debt before getting too excited about its prospects.

Are HEC Infra Projects Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that HEC Infra Projects insiders own a meaningful share of the business. In fact, they own 69% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, HEC Infra Projects is a very small company, with a market cap of only ₹450m. So this large proportion of shares owned by insiders only amounts to ₹309m. That might not be a huge sum but it should be enough to keep insiders motivated!

Is HEC Infra Projects Worth Keeping An Eye On?

HEC Infra Projects' earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching HEC Infra Projects very closely. Before you take the next step you should know about the 4 warning signs for HEC Infra Projects that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HEC Infra Projects might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HECPROJECT

HEC Infra Projects

Operates as an engineering, procurement, and construction (EPC) contractor for electro-mechanical and instrumentation projects in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026