- India

- /

- Aerospace & Defense

- /

- NSEI:GRSE

Undiscovered Gems Including Artemis Medicare Services And 2 Other Promising Small Caps

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by policy uncertainties from the Trump administration, small-cap stocks have experienced varied performance, as evidenced by recent movements in indices like the Russell 2000. With economic indicators such as inflation and interest rate expectations influencing broader market sentiment, identifying promising small-cap opportunities can be particularly rewarding for investors seeking growth potential. In this context, a good stock is often characterized by strong fundamentals and resilience to macroeconomic shifts—qualities that may be found in lesser-known companies like Artemis Medicare Services and other emerging players in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Artemis Medicare Services (NSEI:ARTEMISMED)

Simply Wall St Value Rating: ★★★★★★

Overview: Artemis Medicare Services Limited manages and operates multi-specialty hospitals in India and internationally, with a market capitalization of ₹39.79 billion.

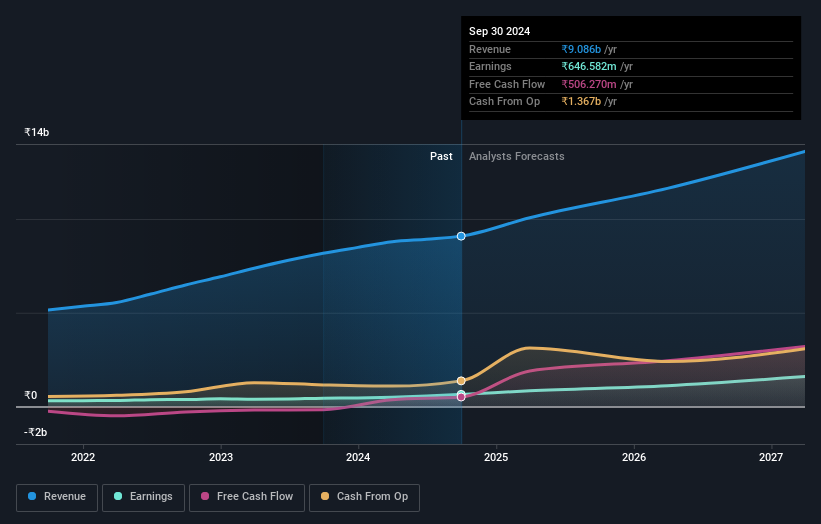

Operations: Artemis Medicare Services generates revenue primarily from healthcare services, amounting to ₹9.09 billion.

Artemis Medicare Services, a dynamic player in the healthcare sector, has shown impressive financial performance recently. The company reported net income of INR 222.62 million for Q2 2024, up from INR 135.93 million the previous year, with earnings per share rising to INR 1.42 from INR 1. Debt management appears solid as the debt-to-equity ratio improved from 37% to 32% over five years, and EBIT covers interest payments by a comfortable margin of 4.3 times. Trading at a significant discount to its estimated fair value suggests potential upside for investors eyeing growth opportunities in this space.

- Click here to discover the nuances of Artemis Medicare Services with our detailed analytical health report.

Learn about Artemis Medicare Services' historical performance.

Ceigall India (NSEI:CEIGALL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ceigall India Limited is an infrastructure construction company in India with a market capitalization of ₹55.26 billion.

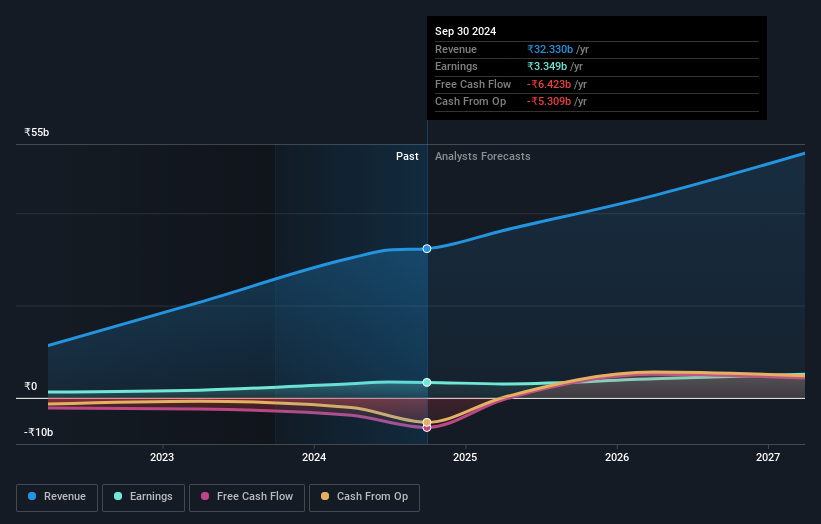

Operations: Ceigall India Limited generates revenue primarily from its Engineering Procurement and Construction (EPC) segment, which accounts for ₹32.45 billion, and Annuity Projects contributing ₹9.90 billion.

Ceigall India, a player in the construction sector, seems to be making strategic moves with its potential sale of road projects valued at $540 million. Its earnings have shown robust growth of 41.5% over the past year, outpacing industry averages. Despite a dip in net income for Q2 2024 to INR 673 million from INR 738 million last year, sales and revenue figures rose slightly. The company's price-to-earnings ratio of 16.5x is attractive compared to the broader Indian market's 31x, and its EBIT covers interest payments well at a ratio of 6.4x.

- Dive into the specifics of Ceigall India here with our thorough health report.

Examine Ceigall India's past performance report to understand how it has performed in the past.

Garden Reach Shipbuilders & Engineers (NSEI:GRSE)

Simply Wall St Value Rating: ★★★★★★

Overview: Garden Reach Shipbuilders & Engineers Limited specializes in designing and constructing warships in India, with a market cap of ₹161.43 billion.

Operations: GRSE generates revenue primarily through the design and construction of warships. The company operates within a market cap of ₹161.43 billion.

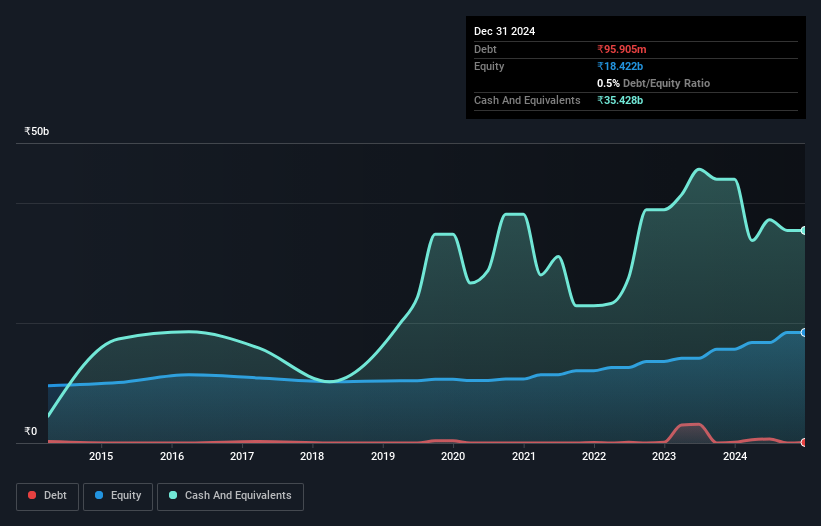

Garden Reach Shipbuilders & Engineers, a notable player in the defense sector, has demonstrated robust performance with earnings growing 20.7% annually over the past five years. The company is debt-free and boasts a favorable price-to-earnings ratio of 42x, which is below the industry average of 54.8x. Recent earnings reports show significant growth with second-quarter sales reaching ₹11.53 billion compared to ₹8.98 billion last year and net income rising to ₹977 million from ₹807 million previously. Notably, GRSE secured a substantial contract worth approximately ₹4.91 billion for an Acoustic Research Ship, highlighting its strong order book and potential for future growth in specialized shipbuilding projects.

Next Steps

- Click this link to deep-dive into the 4640 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GRSE

Garden Reach Shipbuilders & Engineers

Engages in the design and construction of war ships in India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives