- India

- /

- Aerospace & Defense

- /

- NSEI:GRSE

Garden Reach Shipbuilders & Engineers (NSE:GRSE) Is Increasing Its Dividend To ₹5.50

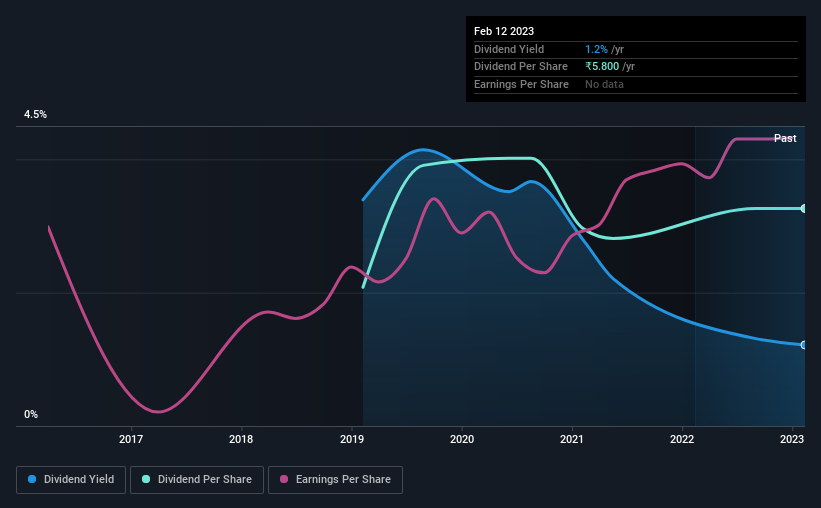

Garden Reach Shipbuilders & Engineers Limited (NSE:GRSE) will increase its dividend on the 12th of March to ₹5.50, which is 11% higher than last year's payment from the same period of ₹4.95. Despite this raise, the dividend yield of 1.2% is only a modest boost to shareholder returns.

See our latest analysis for Garden Reach Shipbuilders & Engineers

Garden Reach Shipbuilders & Engineers' Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, Garden Reach Shipbuilders & Engineers' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

If the trend of the last few years continues, EPS will grow by 20.4% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 28%, which is in the range that makes us comfortable with the sustainability of the dividend.

Garden Reach Shipbuilders & Engineers' Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. Since 2019, the annual payment back then was ₹3.70, compared to the most recent full-year payment of ₹5.80. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. Garden Reach Shipbuilders & Engineers has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see that Garden Reach Shipbuilders & Engineers has been growing its earnings per share at 20% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

Garden Reach Shipbuilders & Engineers Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for Garden Reach Shipbuilders & Engineers that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRSE

Garden Reach Shipbuilders & Engineers

Engages in the design and construction of war ships in India.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives