- India

- /

- Industrials

- /

- NSEI:GODREJIND

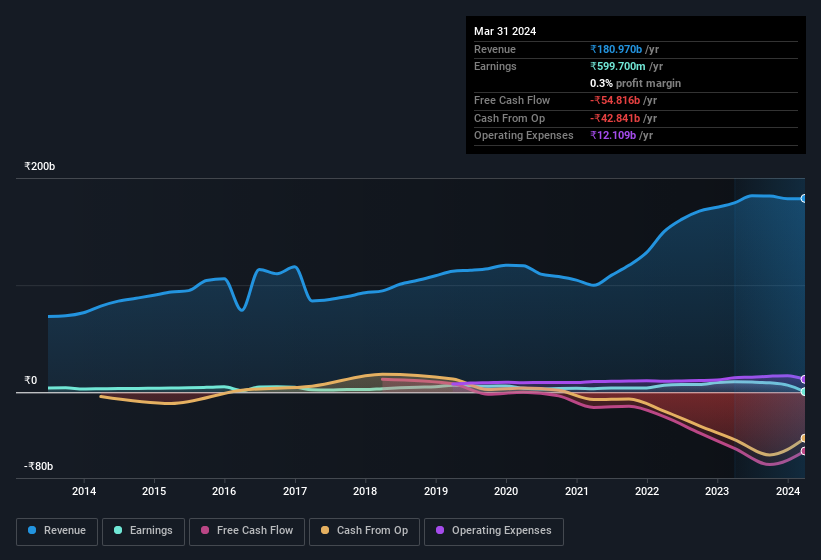

There May Be Reason For Hope In Godrej Industries' (NSE:GODREJIND) Disappointing Earnings

A lackluster earnings announcement from Godrej Industries Limited (NSE:GODREJIND) last week didn't sink the stock price. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Godrej Industries

Our Take On Godrej Industries' Profit Performance

Therefore, it seems possible to us that Godrej Industries' true underlying earnings power is actually less than its statutory profit. If you want to do dive deeper into Godrej Industries, you'd also look into what risks it is currently facing. Be aware that Godrej Industries is showing 2 warning signs in our investment analysis and 1 of those is potentially serious...

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GODREJIND

Godrej Industries

Engages in the chemical, consumer goods, real estate, agriculture, and financial services businesses in India and Internationally.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives