- India

- /

- Industrials

- /

- NSEI:GODREJIND

Here's Why Godrej Industries (NSE:GODREJIND) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Godrej Industries Limited (NSE:GODREJIND) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Godrej Industries

How Much Debt Does Godrej Industries Carry?

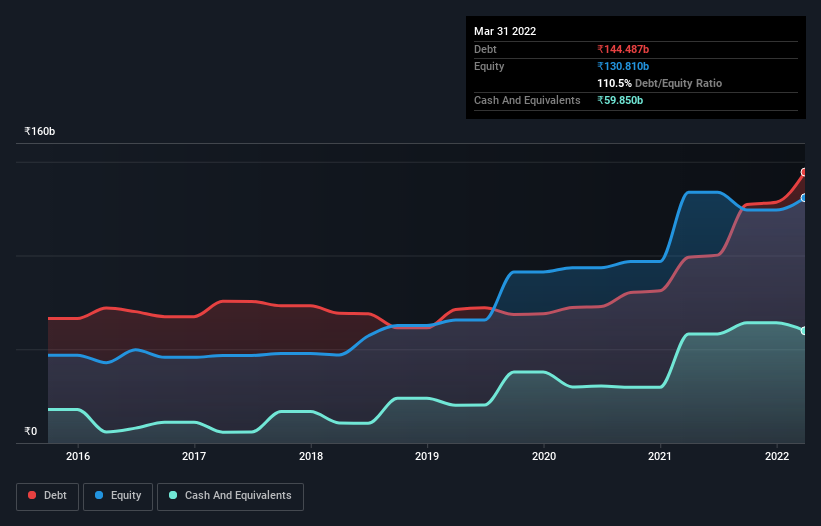

You can click the graphic below for the historical numbers, but it shows that as of March 2022 Godrej Industries had ₹144.5b of debt, an increase on ₹99.0b, over one year. However, it also had ₹59.9b in cash, and so its net debt is ₹84.6b.

How Strong Is Godrej Industries' Balance Sheet?

According to the last reported balance sheet, Godrej Industries had liabilities of ₹150.8b due within 12 months, and liabilities of ₹58.9b due beyond 12 months. Offsetting these obligations, it had cash of ₹59.9b as well as receivables valued at ₹43.5b due within 12 months. So its liabilities total ₹106.3b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of ₹141.1b, so it does suggest shareholders should keep an eye on Godrej Industries' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Godrej Industries's debt is 4.4 times its EBITDA, and its EBIT cover its interest expense 2.7 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The silver lining is that Godrej Industries grew its EBIT by 147% last year, which nourishing like the idealism of youth. If that earnings trend continues it will make its debt load much more manageable in the future. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Godrej Industries will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Godrej Industries burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We'd go so far as to say Godrej Industries's conversion of EBIT to free cash flow was disappointing. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Godrej Industries's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Godrej Industries is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GODREJIND

Godrej Industries

Engages in the chemical, consumer goods, real estate, agriculture, and financial services businesses in India and Internationally.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives