- India

- /

- Construction

- /

- NSEI:GMRP&UI

Investors Still Aren't Entirely Convinced By GMR Power And Urban Infra Limited's (NSE:GMRP&UI) Revenues Despite 31% Price Jump

GMR Power And Urban Infra Limited (NSE:GMRP&UI) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The annual gain comes to 255% following the latest surge, making investors sit up and take notice.

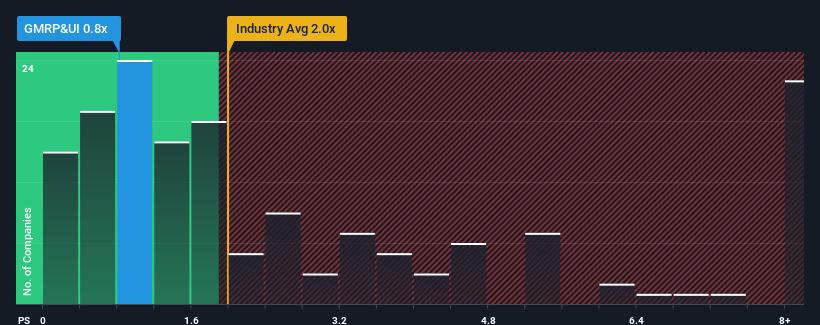

In spite of the firm bounce in price, GMR Power And Urban Infra may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Construction industry in India have P/S ratios greater than 2x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for GMR Power And Urban Infra

How GMR Power And Urban Infra Has Been Performing

As an illustration, revenue has deteriorated at GMR Power And Urban Infra over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GMR Power And Urban Infra will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like GMR Power And Urban Infra's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that GMR Power And Urban Infra's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does GMR Power And Urban Infra's P/S Mean For Investors?

The latest share price surge wasn't enough to lift GMR Power And Urban Infra's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of GMR Power And Urban Infra revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - GMR Power And Urban Infra has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on GMR Power And Urban Infra, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GMRP&UI

GMR Power And Urban Infra

Engages in the energy, urban infrastructure, and transportation businesses in India.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.