- India

- /

- Electrical

- /

- NSEI:GVT&D

How Much Did GE T&D India's(NSE:GET&D) Shareholders Earn From Share Price Movements Over The Last Three Years?

GE T&D India Limited (NSE:GET&D) shareholders should be happy to see the share price up 29% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 69% in that time. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for GE T&D India

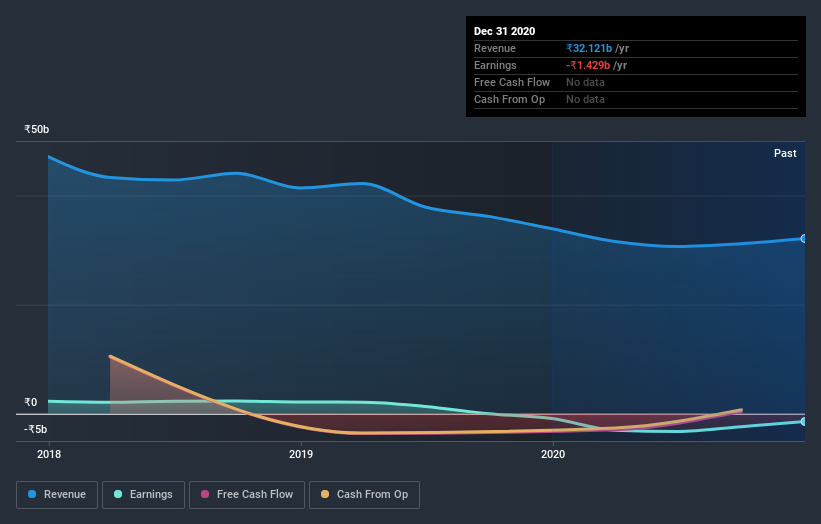

GE T&D India wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years GE T&D India saw its revenue shrink by 15% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 19% (annualized) in the same time period. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

GE T&D India shareholders gained a total return of 6.1% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand GE T&D India better, we need to consider many other factors. Even so, be aware that GE T&D India is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade GE T&D India, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GVT&D

GE Vernova T&D India

Engages in building power transmission and distribution infrastructure in India and internationally.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives