Escorts Kubota's (NSE:ESCORTS) five-year earnings growth trails the 40% YoY shareholder returns

It hasn't been the best quarter for Escorts Kubota Limited (NSE:ESCORTS) shareholders, since the share price has fallen 17% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 421% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Escorts Kubota

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

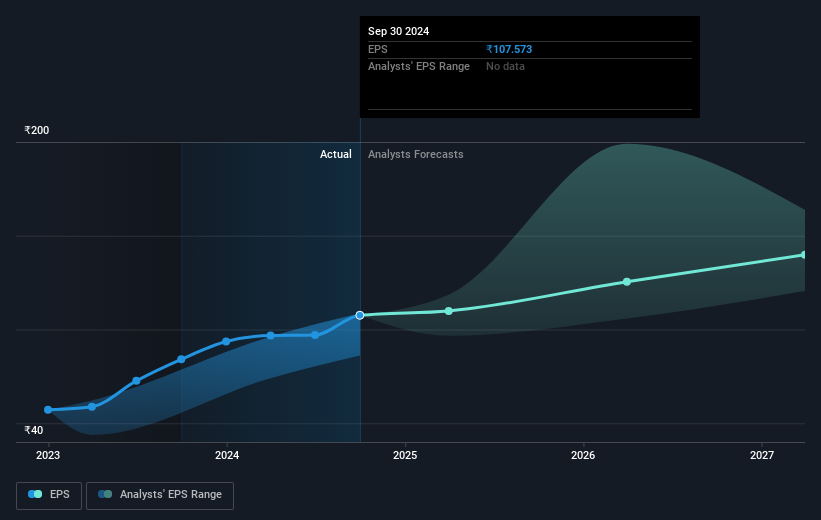

During five years of share price growth, Escorts Kubota achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is lower than the 39% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Escorts Kubota has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Escorts Kubota the TSR over the last 5 years was 432%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Escorts Kubota shareholders have received returns of 18% over twelve months (even including dividends), which isn't far from the general market return. We should note here that the five-year TSR is more impressive, at 40% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. Is Escorts Kubota cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Escorts Kubota might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ESCORTS

Escorts Kubota

Manufactures and sells agri machinery, construction equipment, and railway equipment in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives