Market Might Still Lack Some Conviction On Elgi Rubber Company Limited (NSE:ELGIRUBCO) Even After 26% Share Price Boost

Elgi Rubber Company Limited (NSE:ELGIRUBCO) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 134% following the latest surge, making investors sit up and take notice.

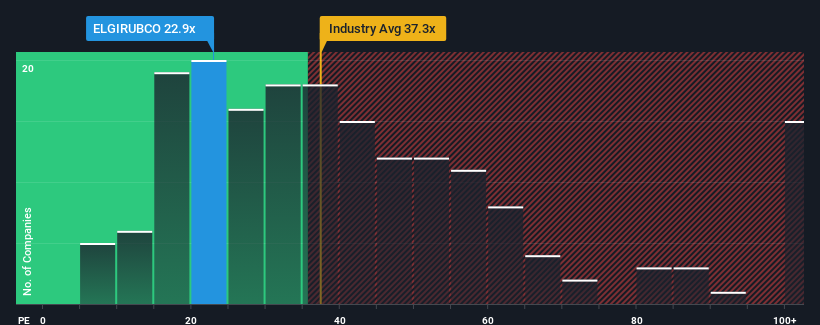

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Elgi Rubber as an attractive investment with its 22.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Elgi Rubber certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Elgi Rubber

How Is Elgi Rubber's Growth Trending?

In order to justify its P/E ratio, Elgi Rubber would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 130%. The strong recent performance means it was also able to grow EPS by 265% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 26% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Elgi Rubber's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Elgi Rubber's P/E?

Despite Elgi Rubber's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Elgi Rubber revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Elgi Rubber (1 can't be ignored!) that we have uncovered.

Of course, you might also be able to find a better stock than Elgi Rubber. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Elgi Rubber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ELGIRUBCO

Elgi Rubber

Manufactures and sells reclaimed rubber, retreading machinery, and retread rubber in India and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.