- India

- /

- Construction

- /

- NSEI:DBL

Can You Imagine How Dilip Buildcon's (NSE:DBL) Shareholders Feel About The 97% Share Price Increase?

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the Dilip Buildcon Limited (NSE:DBL) share price is up 97% in the last three years, clearly besting the market return of around 28% (not including dividends).

View our latest analysis for Dilip Buildcon

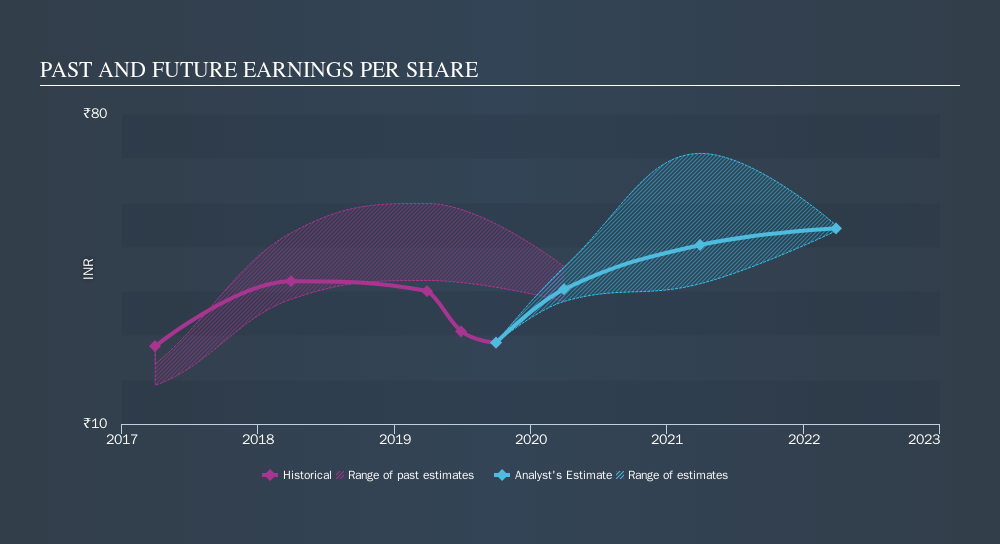

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Dilip Buildcon achieved compound earnings per share growth of 1.0% per year. This EPS growth is lower than the 25% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

You can see how EPS has changed over time in the image below.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Dilip Buildcon shareholders are down 17% for the year (even including dividends) , but the broader market is up 5.9%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 26% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before spending more time on Dilip Buildcon it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:DBL

Dilip Buildcon

Together its subsidiaries, engages in the development of infrastructure facilities on engineering, procurement, and construction (EPC) basis in India.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives