- India

- /

- Electrical

- /

- NSEI:CORDSCABLE

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Cords Cable Industries Limited's (NSE:CORDSCABLE) CEO For Now

Key Insights

- Cords Cable Industries will host its Annual General Meeting on 29th of September

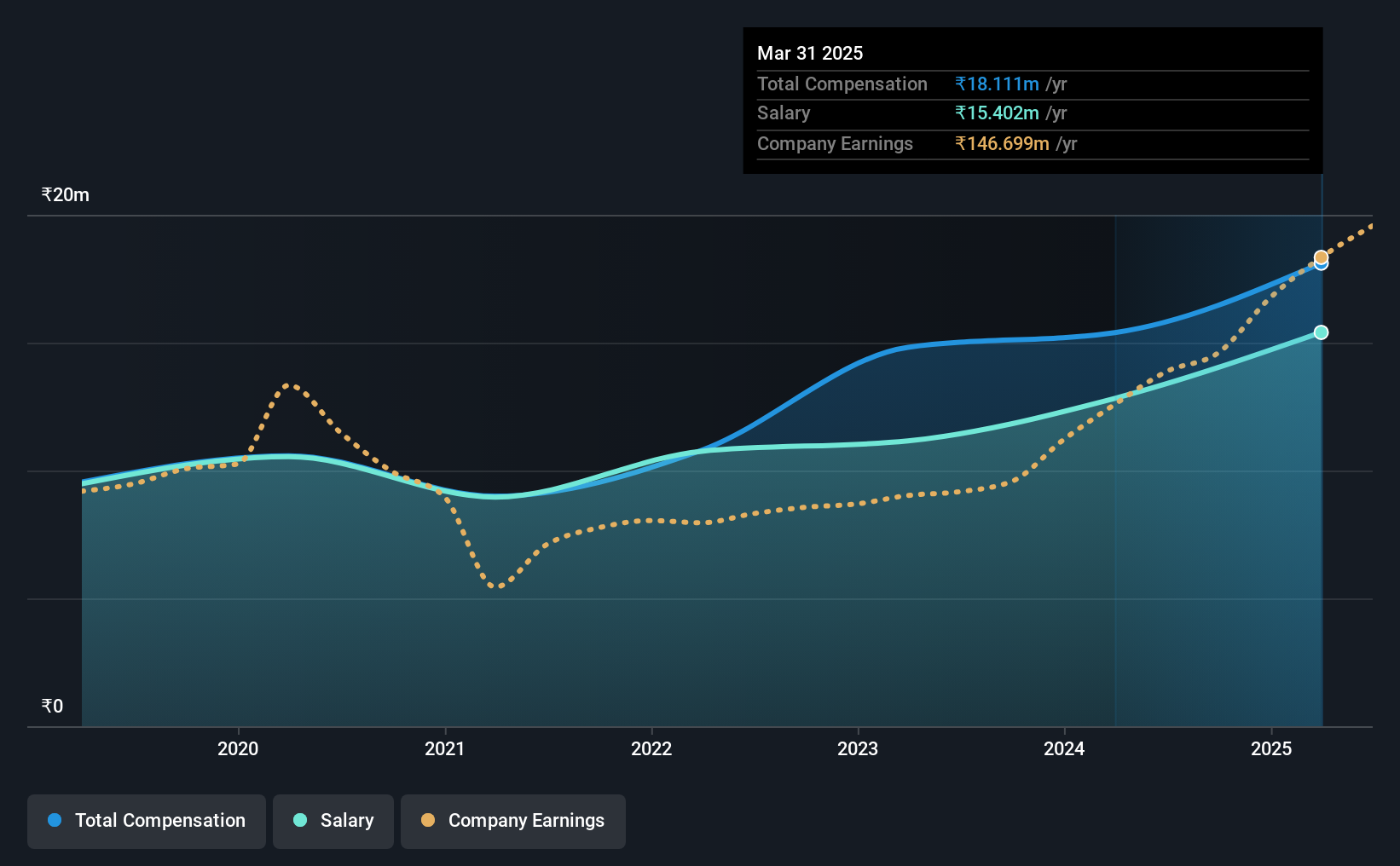

- Total pay for CEO Naveen Sawhney includes ₹15.4m salary

- The total compensation is 201% higher than the average for the industry

- Cords Cable Industries' EPS grew by 33% over the past three years while total shareholder return over the past three years was 209%

Under the guidance of CEO Naveen Sawhney, Cords Cable Industries Limited (NSE:CORDSCABLE) has performed reasonably well recently. As shareholders go into the upcoming AGM on 29th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Cords Cable Industries

How Does Total Compensation For Naveen Sawhney Compare With Other Companies In The Industry?

Our data indicates that Cords Cable Industries Limited has a market capitalization of ₹2.3b, and total annual CEO compensation was reported as ₹18m for the year to March 2025. We note that's an increase of 18% above last year. In particular, the salary of ₹15.4m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Indian Electrical industry with market capitalizations below ₹18b, we found that the median total CEO compensation was ₹6.0m. This suggests that Naveen Sawhney is paid more than the median for the industry. What's more, Naveen Sawhney holds ₹1.1b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹15m | ₹13m | 85% |

| Other | ₹2.7m | ₹2.6m | 15% |

| Total Compensation | ₹18m | ₹15m | 100% |

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. There isn't a significant difference between Cords Cable Industries and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Cords Cable Industries Limited's Growth Numbers

Cords Cable Industries Limited's earnings per share (EPS) grew 33% per year over the last three years. In the last year, its revenue is up 27%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cords Cable Industries Limited Been A Good Investment?

Boasting a total shareholder return of 209% over three years, Cords Cable Industries Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which is a bit unpleasant) in Cords Cable Industries we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CORDSCABLE

Cords Cable Industries

Engages in the design, development, manufacture, and sale of power, control, instrumentation, thermocouple extension/compensating, and communication cables in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives