- India

- /

- Electrical

- /

- NSEI:CORDSCABLE

Should You Be Adding Cords Cable Industries (NSE:CORDSCABLE) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Cords Cable Industries (NSE:CORDSCABLE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Cords Cable Industries

How Quickly Is Cords Cable Industries Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Cords Cable Industries' EPS has grown 32% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

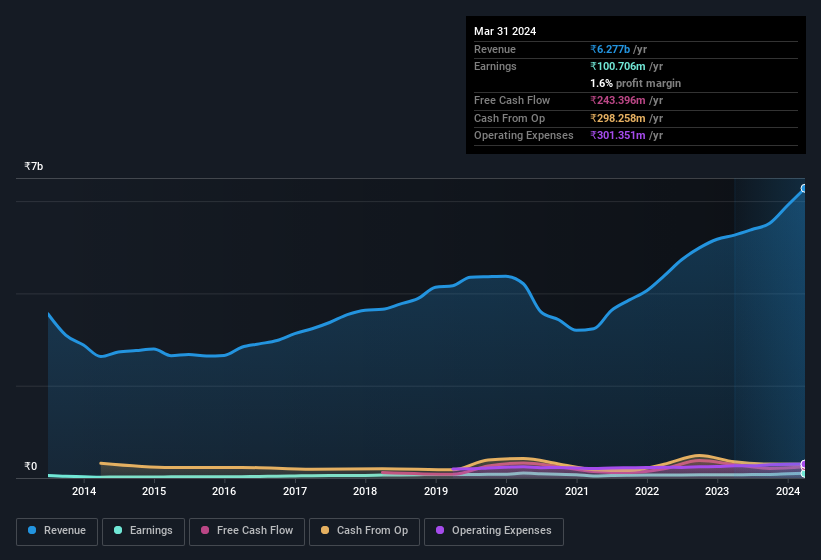

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Cords Cable Industries remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to ₹6.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Cords Cable Industries is no giant, with a market capitalisation of ₹3.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cords Cable Industries Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Cords Cable Industries, is that company insiders spent ₹2.2m acquiring shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. Zooming in, we can see that the biggest insider purchase was by Vice President of Marketing Varun Sawhney for ₹1.7m worth of shares, at about ₹170 per share.

On top of the insider buying, we can also see that Cords Cable Industries insiders own a large chunk of the company. To be exact, company insiders hold 55% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹1.8b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Cords Cable Industries To Your Watchlist?

You can't deny that Cords Cable Industries has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Still, you should learn about the 4 warning signs we've spotted with Cords Cable Industries (including 1 which shouldn't be ignored).

Keen growth investors love to see insider activity. Thankfully, Cords Cable Industries isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CORDSCABLE

Cords Cable Industries

Engages in the design, development, manufacture, and sale of power, control, instrumentation, thermocouple extension/compensating, and communication cables in India.

Solid track record with low risk.

Similar Companies

Market Insights

Community Narratives